Alameda Research faces scrutiny and disaster after insolvency rumors.

Alameda Research - November 6th-7th

Alameda Research is a “principal trading firm” in their own words, which Sam Bankman-Fried owns alongside the cryptocurrency exchange FTX. These two separate entities make up the majority of SBF’s crypto ventures. They are also a lot more intertwined with each other than what meets the eye.

The past few days have been met with speculation and controversy regarding FTX and Alameda, as there are alleged reports that both companies are insolvent. These rumors began when people noticed on Alameda’s balance sheet that a large portion of their assets were FTT tokens, which is FTX’s token. When news broke, people began withdrawing funds from FTX under the assumption that this revelation would cause a collapse in the symbiotic relationship between Alameda and FTX, this also caused FTT’s price to plummet 33% on November 6th due to the rumors.

Alameda is having to transfer funds/reserves to FTX as the exchange is experiencing a bank run where investors are withdrawing their funds from the exchange at an alarming rate after news broke.

The above chart shows stablecoin reserves on FTX, where you can see the absolutely devastating downtrend the last few days given the rumors explained in this article regarding FTX. This is almost a 95% drop from ATH. FTX has processed billions of dollars in withdrawals and deposits in the last couple days according to a tweet from Sam Bankman-Fried, who claims they are ‘doing fine and will continue to move forward’ amongst the massive amount of capital leaving the exchange. However these tweets are now deleted, likely due to the false claims that FTX was fine and that assets are fine.

The other issue with Alameda is that a majority of their assets on their balance sheet are made up of FTT. Alameda currently holds a little over $7 billion USD worth of FTT across their balance sheet, while their total assets amounted to around $14.5 billion USD. FTT has a market cap of 3 billion USD, and fully diluted it’s 7 billion. In other words, Alameda basically owns the entire FTT token liquidity and then some. Even then the asset is highly over inflated and could never be liquidated ethically or completely by Alameda. Not to mention that the investing firm holds 50% of their assets in one token which traditionally is an excessively large percentage and extremely risky position that could collapse the firm entirely.

Alameda Research - November 8th

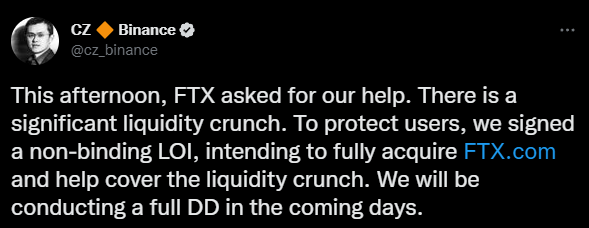

In a shocking turn of events on November 8th, CZ (CEO of Binance) announced in a public tweet that Binance intended to buy out FTX and “help cover the liquidity crunch” they were facing.

This adds even more complexity to the story, as 2 days ago on the 6th it was also CZ/Binance who questioned the illiquidity of FTX on the first day and added fuel to the fire regarding the insolvency rumors. Additionally beginning to sell their FTT position and causing the price to drop as well.

In what some could call a coordinated assault on their top competitor, it seems that the past 3 days has shifted from CZ (at the very least) amplifying the concerns of insolvency in FTT and Alameda to causing a bank run on FTX, to then fueling the fire more with an announcement that he may purchase the company entirely. The agreement is non binding however and he can back out at any moment.

Currently, FTT has fallen from around $25 pre-rumors to currently sitting at $6.15. This is after hitting an all-time low of $2.51 just 3 days since this all started.

Alameda CEO Statement

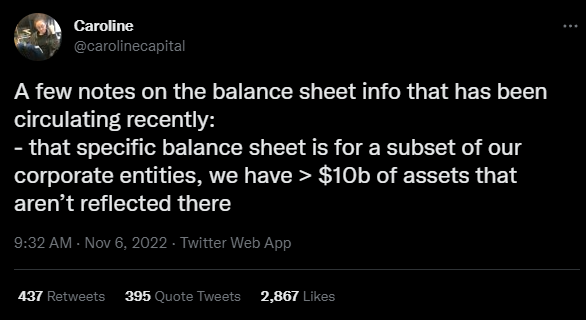

Time will tell what happens over the next few days/month as there is still so much more to unravel in this story. CEO of Alameda Research claimed on twitter that the firm had.

“$10b of assets that aren’t reflected there [balance sheet]” - Caroline Ellison CEO Alameda Research

Now, whether or not we find out if those 10 billion USD of assets are illiquid Sam Bankman-Fried tokens that they can’t sell will probably be a key deciding factor in determining if this truly sends FTX and FTT to the grave. On the other hand, if by some chance they are holding liquid assets they can use to pay off loans and facilitate transfers on FTX then this story might not end in a brutal way.

About the Author

Crypto Enthusiast for over 6 years now. Working full time in DeFi since 2021.