Binance

Binance Review 2023: An Expert's Comprehensive Analysis

4.4

4.5

4.7

4.5

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Lite version great for newcomers

Great security and support

Great learning tools

Requires users to learn and pass tests before complex trading is allowed

Emergency insurance for users

Proof of Reserves easily available to view

Cons

Steep learning curve on Pro version

Has been involved in some major controversies

Limited / banned access in some countries / states

Outspoken CEO

Key Takeaways

Origins

Introduction

A company that needs little introduction, Binance is the largest and most well-known cryptocurrency exchange in the world, with an estimated 29 million active users trading and holding assets on the platform.

Its global dominance and staggering annual volume are matched only by its bold strategies and opinions – particularly in the case of its vociferous CEO, "CZ" – making it a DeFi force to be reckoned with.

No stranger to the spotlight, the company has made huge waves in the industry, with lauded highs – such as a marketing partnership with footballing legend Christiano Renaldo, to critical lows – controversial tweets, and the exchanges’ unwitting use by North Korean hackers.

For those considering its platform – or anyone just curious to learn more about the auspicious company, it's time to take a deep dive into all things Binance.

History

The world of cryptocurrency moves fast, and the growth of pioneering companies is no exception. Created by Changpeng Zhao (AKA ‘CZ’) in July of the 2017 bull-run, it took just six months for the company to become the largest centralized crypto exchange (CEX) in the world.

Not a bad start.

Binance itself came as the follow-up to a high-speed trading system the Chinese/Canadian businessman had previously created for brokers as he attempted to replicate and expand on that success - using an Initial Coin Offering (ICO) to raise the $15 million necessary for the company's creation – and commencing trading just 11 days later.

Shortly after its inception, Binance attempted to set up headquarters in multiple countries, before settling on the Cayman Islands, (with its American subsidiary, Binance.us laying roots in San Francisco).

At the same time as its centralized exchange launch, the company also released BNB – its own native cryptocurrency utility coin, which gave holders various benefits, such as discounted trades on the site.

Two years later in April 2019, the company released the Binance Smart Chain (BSC), designed to be a direct competitor to the fast-growing Ethereum network, appealing to traders and project creators alike by offering faster transaction times and lower gas fees. Read more about BSC here.

On April 2 2020, Binance completed the purchase of popular aggregated cryptocurrency data website, CoinMarketCap. The rumored purchase amount was $400 million USD, although the exact figure has never been officially disclosed by either side. This article by CoinDesk goes in depth on why CZ decided to acquire 'CMC'.

The deal with CMC was just one of many expansion routes, and to date, Binance boasts a complex ecosystem comprising a myriad of additional subsidiaries.

These include:

User Experience

Ease of Use & Design

Crypto trading can be confusing, and Binance has led the charge in simplifying the whole process for its numerous users. Indeed, if an individual downloads the mobile application and completes KYC (which is required for all users) they are first presented with Binance Lite – a simplified version of the platform, specifically designed for and aimed towards novice users.

Lite does away with complex trade pairings and instead allows individuals to deposit, buy, and trade their crypto with a few simple clicks. In both versions of the app, funds can be added within minutes from a card (with banks requiring somewhat more convoluted steps, such as direct money transfer to verify), or a handful of other means.

Withdrawing is much the same, with set fees being applied to varying withdrawal destinations, which vary from country to country.

On the pro version of the app, Binance takes extra steps to ensure financial awareness and risk assessments by forcing users to view videos / read articles and then take quizzes on the specific trading service they wish to use.

Only once a top-of-the-class 100% is achieved are users set free into the world of trading and allowed to fend for themselves. In terms of due diligence, Binance has to be commended for going a step above to hammer home the old adage of ‘only risk what you are willing to lose.’

From a UI and UX standpoint, Binance is very intuitive to navigate, and its various features easy to find, but the design leans in heavily to its stark black and yellow theme – and isn’t for everyone. Of course design and color comes down to personal preference, and after all, 1 Bitcoin is still 1 Bitcoin…whatever color it’s presented in.

Usage and Popularity

Simply put, when it comes to crypto exchanges, Binance is king. The company has climbed the ranks in a remarkably short space of time, appearing from seemingly nowhere and growing its total users from 1.5 million in 2017 to over 29 million by 2022.

During the bull run of 2021, the exchange hit its 24-hour trading peak at a touch over $76 billion. Of course, highs can only last so long, but despite now being in a long and painful bear market, the platform still manages a very healthy average of $14-20 billion trading volume per day.

Furthermore, its native BNB token has been a resounding success and is now the third most traded cryptocurrency in the world at the time of this review, outpaced only by Ethereum and the OG crypto heavyweight, Bitcoin.

In terms of listed tokens themselves, Binance’s lofty status allows it to be very selective in who passes through its gates (likely coupled with the fact that those who aren’t lucky enough to become part of Binance Labs must cough up a rumored $100k price-tag for accepted listings).

The number of listed cryptocurrencies is always in flux however, as the company actively monitors those it allows on its site, and will quickly deactivate trading on any it deems to be embroiled in suspicious or contentious behavior – such as Helium Network Token (HNT) for its apparent poor revenue and misleading marketing, or the infamous Luna token, after its implosive May 7 collapse.

The exchange currently sits on a total of 355 cryptocurrencies / DeFi tokens available for trading, spread across 1446 trade pairs.

However, it’s not been all sunshine and NFTs for Binance, and their quest for global DeFi dominance has been thwarted in several countries for a variety of reasons – such as their new stock tethered tokens blurring the lines between crypto and regulated stocks, poor transparency, ongoing fraud investigations in the US, and a lack of regulation in the crypto space as a whole.

Restricted locations include specific states (such as Hawaii, New York, Texas) in the USA, Singapore and Ontario (Canada). Other countries have restricted usage and disabled features (such as Futures trading) due to specific regulations and / or trading license issues.

The affected countries include China, Malaysia, Japan, Germany, Italy, the Netherlands, UK, and Thailand. In the US, Binance setup its sister company Binance.US to better comply with the country’s trading laws, which then saw it permitted back in 44 of the 50 states.

Customer support

Just in case there was an issue, Binance doesn’t slack on its customer support.

Most issues can typically be found and resolved via its useful and simple-to-use Help Center, which features literally hundreds of specific posts created to aid users in finding solutions to the most common issues that can occur on the platform – all conveniently compiled into relative sections, like passwords, missing crypto, account issues, etc.

There is also a useful search section, for when the necessary information isn’t readily available.

If the Help Section doesn’t tackle the issue, Binance does have direct methods of support. There is even a not-well-advertised direct support line for US customers, but for those who are unwilling to search the four corners of the internet to find it – and the rest of the population outside the US – its main support system is via its 24/7 live chat system.

It's simple, friendly, and easy to use – typically garnering a response within 10 minutes, (but often sooner).

Slower ways include submitting a request through a registered account, (which then narrows down the issue through a series of multiple-choice responses,) or joining the Twitter horde and dropping a DM to @BinanceHelpDesk.

Honestly, though, these options can take a while, so Live Chat is the clear way forward.

Fees and Promotions

Fees

Due to their sheer size, Binance is able to offer some of the most favorable fees to users available in the market. Currently, their trading costs for ‘regular’ users (I.E. those trading under $1 million USD value per 30-day period) are 0.10% for both maker and taker fees, but benefit from a further 25% discount at 0.0750% when paying fees using BNB.

In terms of Futures, the costs are an attractive 0.020% on makers and 0.050% on takers when trading and paying fees with USDT, or a 10% discounted 0.0180% and 0.0450% when using BNB to cover trading costs.

These fees are even less when trading using the Binance partner Paxos created BUSD, at 0.0120% and 0.0300% on maker and taker respectively, and 0.0108% and 0.0300% when applying the 10% BNB discount.

As an important note this is when trading on USDⓈ-Margined Futures contracts, which are linear products quoted and settled in U.S. dollar-pegged stablecoins – USDT or BUSD

In addition, the platform features varying VIP levels for high-volume traders, which give unique benefits and discounts.

There are 9 levels in total, with the higher tiers offering greater benefits. For example, level 1 VIP requires $1 million BUSD equivalent value in 30-day spot trading or $15 million in monthly Futures trading, and a BNB balance of 25BNB in holdings.

The benefits include discounted trade costs – namely 0.0900% and 0.1000% on maker and taker fees and 0.0675% and 0.0750% when using BNB to pay them.

This equates to a further 10% discount on maker fees when using BNB as a VIP. Interestingly, in terms of Futures, VIP members only benefit from trading in USDT over regular users, where they get maker costs lowered to 0.0160% or 0.0144% with the BNB discount (a 20% saving on the latter).

God-tier Level 9 in comparison, requires an eye-watering $4 billion BUSD 30-day spot trades or $25 billion in futures, as well as over 5,500 BNB in holdings.

The lucky few at this level will benefit from a huge daily withdrawal upgrade of $96 million instead of the basic $8 million available to regular users, and a vast reduction in fees, namely paying just 0.0150% / 0.0300% in BNB paid maker/taker fees on spot trades (a discount of 80% on maker and 60% on taker).

For those that can trade at these unearthly levels, the VIP system is definitely worth taking part in.

In terms of deposits and withdrawals, Binance does not charge any fees on crypto or Fiat deposits, but it does offset the processing cost of either the bank or card used and forwards the cost to the user.

I.E. to deposit from a Visa or Mastercard in the UK, the charge is 1.8% of the amount deposited, equivalent to an £18 charge on £1000

It is definitely worth going through full bank verification for access to lower processing costs, as the fee for the same previous example above from a verified UK bank would be just 50 pence, saving the user £17.50.

In contrast Crypto withdrawals from Binance have a flat fee to cover the cost of moving the relevant token out of the account to the new location.

Crypto withdrawal rates are not determined by Binance itself but rather the relevant blockchain network, and can vary due to high gas fees and network congestion.

The site benefits from a convenient open page where users can check the current withdrawal costs of the selected cryptocurrency.

For Fiat withdrawals, the withdrawal cost varies by country and method (E.g. it costs the maximum flat rate of $15 to withdraw to a US bank account via SWIFT, but is only £1 if transferring to a UK bank).

The same handy page allows users to check relevant withdrawal costs before committing.

Comparison

As it stands, for simple ease of use and global reach, Binance does not have many competitors. After the catastrophic fall of its leading competitor FTX less than a month ago, the company has widened the gap between itself, and its closest next competitor – Coinbase.

When pitting them head-to-head, it all depends on whether the individual is located outside of the US. If so then it's a pretty clear win – Binance has access to far more cryptocurrencies than its rival (some 300+ compared to 90+).

However, this is completely reversed if the user is a US resident, as Binance.US currently only holds just over 60 tradable assets.

There is also simply no question that Binance offers more trading features, and therefore preference comes down to what an individual needs an exchange for. If they simply want to trade a handful of well-known assets then Coinbase is a potentially strong alternative, with its stripped-down simplicity being a key selling point.

In addition, you also have coinbase's aggressively streamlined and uncluttered user interface that could be argued is far superior to Binance’s own – but once again that is largely subjective. Overall, the better choice depends on where the user lives, and what they require the exchange for.

Safety Essentials

Security

From hacks, to exploits, and outright theft, the decentralized finance sector is unfortunately no stranger to fraud designed to pry funds from the hands of unwitting individuals, and as such those operating within the space take their financial security very seriously.

It appears that Binance shares the same sentiment, and by its own words has made: “user protection [their] top priority by embedding state-of-the-art security measures and strict data privacy controls across the Binance system.

This protection breaks down into multiple facets, which include the vast majority of user funds and assets being stored in offline, cold storage facilities

Binance also utilizes real-time monitoring via their risk assessment team, who solely focus on the analysis of:

Suspicious behavior ends up resulting in an instant 24-48 hour withdrawal ban whilst investigation takes place to protect the user.

The company holds itself to high standards too, with Binance’s own personnel infrastructure containing detailed security measures, including threshold signature scheme multisigs, designed to ensure that transactions require multiple sign-offs and that no single individual has access to all private keys and direct user funds.

Furthermore, simply by just utilizing the service, users themselves are automatically protected through a variety of means, including ‘safe-sign-ins’ – which include secure two-factor authentication, and SMS/Email confirmation.

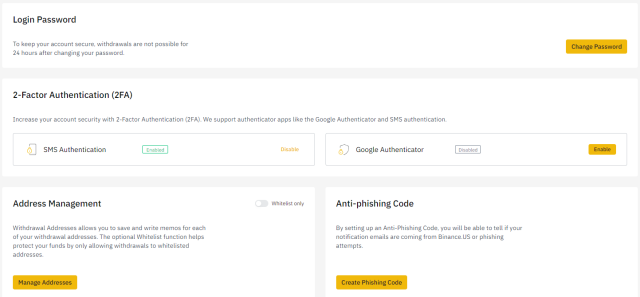

Advanced options for those wanting to be extra safe include:

All suspicious activity is always presented to the user in real-time through push and on-app notifications, which will then allow the individual to take back direct control with the support of Binance if compromised while banning unwanted third parties.

Lastly, user identities are fully protected, with their KYC (Know Your Customer) information being held in encrypted data storage, and any data in transit secured using end-to-end encryption, preventing third-party access.

While the above certainly shows that Binance takes security very seriously, they are not impervious to attacks – such as the $570 million Binance Bridge hack in October 2022. (It is important to keep in mind that no user funds were affected at the time, but goes to prove that although such exploits are very rare, they can occur).

Controversy

Despite its size and prowess Binance has unfortunately not remained clean from scrutiny and scandal, and as such has taken its fair share of subsequent criticism from cryptocurrency naysayers.

Major news reporting site Reuters has supposedly uncovered many embarrassing scandals involving the exchange, such as in September 2020, when Lazarus (a North Korean hacking group) gained access to Eterbase – a small Slovakian exchange – and stole $5.4 million of assets, rumored to be to help fund their country’s nuclear weapons program.

They then opened anonymous accounts on Binance and converted the assets repeatedly to obscure the money trail and moved it all in under 9 minutes. This was all while Binance – according to Eterbase founder, Robert Auxt said they:

had no idea who was moving money through their exchange.

According to Reuters this is just one example of several floods of illegal money – (another being the Hydra dark web scandal that could fill a whole article in and of itself) – that has flowed through the exchange since 2017, discovered as part of the media outlet’s 2021 investigation.

Another aspect of the Reuter’s investigation claimed that Binance had provided Russian Intelligence Agencies with user data in April 2021 (including names and addresses), when their money laundering department, Rosfin, sought to track millions of dollars in Bitcoin that had been raised by Russian opposition leader Alexei Navalny. Binance vehemently denied the allegations, stating simply that:

suggestions that Binance shared any user data, including Alexei Navalny, with Russian FSB controlled agencies and Russian regulators are categorically false.

In May 2021, Binance was placed under investigation by the US Department of Justice and IRS on allegations of money laundering and tax offenses.

Shortly afterward in June 2021, the UK’s financial Conduct Authority ordered that Binance cease all regulated activity in the country.

It is crucially important to make a distinction here between being investigated and being accused, and as yet federal agencies have not directly accused Binance of any wrongdoing.

On April 21 2022, in accordance to Russia's war with Ukraine, Binance restricted access for Russian nationals and native companies, stating that those with over €10,000 euros in holdings would be unable to deposit further funds or trade (although they would still be able to withdraw), following the EU’s 5th package of restrictive sanctions on the nation, but refused to do a blanket ban, stating that it would not “unilaterally freeze millions of innocent users accounts.”

This decision was met with criticism from some, who felt that refusing to do so was potentially aiding the Russian war effort, while supporters praised Binance’s stance, stating that it should not be a crypto company’s responsibility to punish an entire nation for the acts of their leader.

On the much lower end of the controversy scale, Binance’s outspoken CEO CZ has come under occasional fire for his tweets, which take zero prisoners. His immortal: “If you can’t hold, you’ll never be rich,” post was lamented by some investors, who reportedly took him directly at his word and lost apparently large financial gains by refusing to take profits under this ethos.

More recently a largely unreported tweet from CZ about how exchanges were safer places to store assets than hard wallets came under scrutiny after the total collapse of the second largest cryptocurrency exchange, FTX.

As recently as last week the Binance CEO appeared to call into question the BTC holdings of Coinbase in a since-deleted tweet, stating that “Coinbase Custody maintains 635,000 BTC on behalf of Greyscale…4 months ago they had less than 600k.”

He later explained that he was simply quoting an old news article from Bitcoinist, but was called out for adding further turbulence to the already unstable situation the industry has found itself in across the past few months.

Of course it should go without saying that these are just the opinions of one person and like Elon Musk, a ‘celebrity’ on social media should never, ever be seen as a source of credible financial advice.

Proof of Reserves

The sudden collapse of FTX, which wiped out billions in user funds literally overnight has raised a lot of hard questions about the industry, specifically the secrecy surrounding what exchanges do with user funds and how they are stored.

As such, many have voluntarily come forward to publicly share their business information – specifically their proof of reserve balances and all associated wallets – for full transparency and scrutiny.

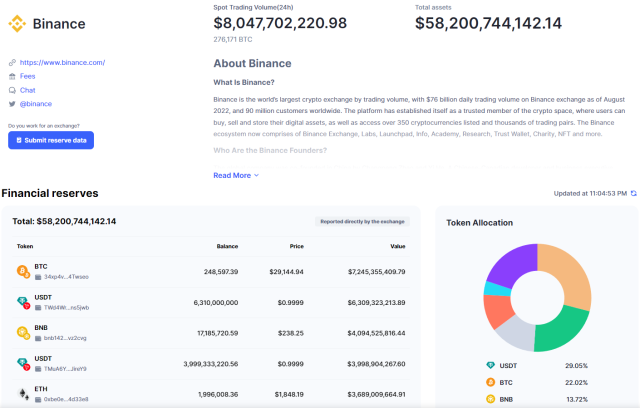

Sites displaying this information include Coin Gecko and Binance’s own CoinMarketCap. One of the first to take part in this new metric, Binance displayed all of its information to anyone caring to look, and was shown as follows:

At the time of writing, Binance held assets in its numerous cold wallets totaling a staggering *$68,553,644,252.01 (68 billion, five hundred and fifty-three million, six hundred and forty-four thousand, two hundred and fifty-two dollars and 1 cent).

This was largely broken down into BUSD and USDT stablecoins (32.47% and 22.84% respectively, totaling approximately $34 billion) with the largest next three holdings comprising Bitcoin, BNB, and Ethereum (combining to 30.84%) with the remaining 13.8% distributed into dozens of other cryptocurrencies, such as Fantom, Axie, and Tron.

*It is worth keeping in mind there is a significant discrepancy for the displayed value of assets held depending on the site reporting it. Coin Gecko puts Binance’s holdings at a lower scale $65.4 billion compared to CMC’s declared $68.5, creating a substantial differential of $2.9 billion USD. This could potentially be due to a delay in relevant site updates of fluctuating market costs.

Conclusion

There is no ignoring the fact that when it comes to pushing the envelope of cryptocurrency exchanges forward, Binance is ahead of the pack by a country mile.

It has the most users globally, the largest trading volume per day, a vast variety of trading features (depending on location), a ton of cutting-edge security features to help keep people financially secure, a robust help center when things do go wrong, and an app that makes trading as easy as 123.

In addition, Binance is very discerning about which tokens get listed on its site – and subjects them to constant analysis – allowing users to trade with increased confidence.

Add to this the fact that the company has created one of the most popular cryptocurrencies in the world, and it's understandable why Binance has become an industry giant.

However, DeFi is a volatile space and no company can ever truly guarantee the financial safety of its users, despite their claims.

Binance is unfortunately no stranger to scandal and investigation either, and whether or not the latter is deemed to be legitimate or a glorified witch hunt, it is still advisable to be sensible and aware of potential risks when using the platform.