Binance.US

Binance US Review 2023: An Expert's Comprehensive Analysis

4.3

4.4

4.7

4

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

High-speed trade execution

Low fees compared to rivals

Supports popular cryptocurrencies

A straightforward platform for novices

Allows staking - potential to earn passive income

Detailed identification progress for further protection

Cons

A complex fee structure that varies based on the assets being traded

Only has a few crypto assets compared to competitors

It is not available in all 50 States in the USA

Binance US is without an official headquarters

The parent company was hacked in 2019

Lengthy identification customers may put customers off

No phone support

Key Takeaways

Origins

Introduction

Considering the overwhelming number of crypto exchanges floating around the centralized exchange space – all of which have contrasting advantages, (whether more trading pairs, cheaper fees, or user discounts) – it is vital to note that Binance US is up there regarding affordable fees and ease of use. Spearheaded by Brian Shroder (CEO), Binance US is definitely in the conversation when US users are asking themselves what is the best crypto exchange to use? Binance US is very similar to the parent platform binance.com and much of what the world loves about that platform is present in the US version, with a strong focus on user experience and safety.

Regardless of the exchange’s seeming generosity and user-first business model, it is still far from perfect. Binance US does not offer the total of 350+ cryptocurrencies to its sister company, and instead supports a lackluster 146.

But does it make up for these disappointments in other ways? Join CoinScan as we dive deep to discover the good, the bad, and the ugly of Binance US.

History

The name “Binance” comes up so often everywhere in the cryptocurrency world, it may feel like there is no escaping the brand. And it’s no wonder – this international exchange has become the world’s largest crypto exchange, making a name for itself worldwide, led by the indomitable Changpeng Zhao (CZ) since launching in 2017.

Interestingly, when Binance International first launched in 2017 in the Cayman Islands, it supported US members.

However, in 2019, it stopped catering to its American customers due to US regulators investigating the platform for potential money laundering and tax evasion violations.

Thus, the parent company, Binance International, created Binance US alongside other investors, registering it as an American company specifically to deal with any potential compliance issues for US customers that had plagued the international parent company.

User Experience

Ease of Use and Design

Like most other major other exchanges, Binance US is a platform easily accessible on desktop and mobile. For straightforward trading while on-the-go, users can enjoy the exchange’s mobile apps, which are available on iOS and Android.

Unlike many other crypto marketplaces, which are suitable for crypto novices or enthusiasts, not both, Binance US can cater to all types of customers without a knowledge gap getting in the way. For instance, beginner investors can quickly enter the amount they want to spend on the platform using the 'convert' feature to purchase cryptocurrency without dealing with a complicated advanced trading interface.

They can also easily set up recurring buys for those wanting to create a regular investment strategy such as daily cost averaging ("DCA").

More experienced traders, on the other hand, can get more out of the platform by using the following:

Additionally, institutional investors can benefit from the exchange’s lower fees and real-time data. With Binance US, there is a little something for everyone on the platform, as it caters to traders from across the entire knowledge spectrum, from little crypto knowledge, to full-blown professionals or algorithmic traders.

On top of everything else, Binance US rolled out Binance Pay, a contactless and borderless payment gateway on its app just this month. The feature allows users and merchants across the globe to make payments with crypto with any supported cryptocurrencies boasting a wild zero gas fee and transaction fee structure.

As a result, Binance US customers do not need to enter complex deposit or withdrawal addresses to make transactions. Rather, settlements are facilitated by the exchange with a crypto-to-crypto gateway supporting numerous assets, like BNB, Ethereum, Bitcoin, and various stablecoins.

Usage and Popularity

Until very recently, Binance prioritized user experience over regulatory concerns. However, the exchange has changed its tune, growing its compliance team by a substantial 500% in 2021 going into 2022.

Regardless, as regulators worldwide focus on cryptocurrency investor safety – especially in the wake of the FTX collapse – it remains to be seen whether or not Binance US’s compliance approach is enough to reassure a visibly shaken cryptocurrency investment market.

Thanks to having 146 coins & 326 trading pairs available on the exchange, the platform’s 24-hour volume is reportedly $295 million as of the writing of this article. Out of curiosity, and despite having its own native token BNB, the most active trading pair is BTC/USD, with a 24-hour volume of $147,294,935.01, coming to over half of the total volume traded.

Staking is a popular feature on Binance US, where users can earn up to 14% APR by locking their deposits for a set amount of time, depending on the cryptocurrency held. With ETH at 6% APR staking on Binance US is seen by many as a great way to see passive return on investments.

Staking, especially staking on centralized exchanges, has recently come under fire as US-regulated heavyweight Gemini had its staking program collapse in the wake of the insolvency of FTX.

Depending on continued business growth, the exchange hopes to go public within three years in a similar manner to its rival Coinbase, in order to bring more users onto the platform, therefore, driving trading volume and furthering assurances that it is a solvent and trustworthy centralized exchange.

Customer Support

Binance US, like many other exchanges – including Coinbase and its parent company Binance – seems to prefer dodging moody customers and the dreaded angry phone calls.

As such, on the platform, users can only get support through the exchange’s ticket system or via email. Although the likelihood of any issue being solved eventually is high, this isn’t good enough for numerous users who may want to get help immediately for peace of mind – especially those trusting the exchange with a generous chunk of crypto and other digital assets.

Reported solution times often take longer than expected for users, contributing to the perception that Binance US’s customer support is inefficient.

Similarly to most exchanges (which are just as criticized for having a lackluster customer support system), Binance US also presents topics related to common questions asked and answered on its platform.

Some questions include, “What’s the best way to earn interest on crypto on your platform?” and so forth. Once selecting a topic, users receive an open-ended input field, which gets assigned a support ticket.

While Binance US has 24/7 live chat support, it is a robot that often gets confused and responds in frustratingly wrong ways. Although the answers to user questions are eventually answered whether via email to a support team member or through the 24/7 live chat support, it can take a significant amount of time to get to the point.

In fact, by the time the questions are answered, customers have given up altogether and taken their business elsewhere in the hope of better support.

Fees and Promotions

Fees

Compared to many of the exchange’s rivals, Binance US offers significantly lower trading fees alongside discounts for high-volume traders, making it a popular choice for many US citizens. For instance, it is currently the only major exchange in the US that offers free Bitcoin trading.

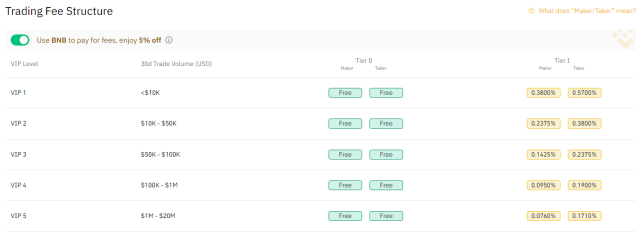

Moreover, the platform’s maker/taker fees are easily affordable for all walks of life, varying from 0% to 0.57%.

Instant buy fees are also just 0.50%, and buyers of Binance's native token (BNB) and spot traders can also enjoy discounted fees of 25% when using BNB to pay for the fees.

BNB itself is the third-largest cryptocurrency when not accounting for stablecoins such as USDC and USDT. In part due to its name recognition, part due to its usefulness, and part because it’s the gas token of its own chain, BNB maintains its market position by having a preferential position within Binance’s ecosystem.

As mentioned above, traders have the ability to receive discounts on fees when trading on Binance (International) or Binance US when paying in BNB, while trading volume determines the amount of the token removed from circulation every quarter, driving scarcity, and therefore supporting a higher price over time.

Although discounted fees seem like a generous offer, it’s important to note that the platform is more giving to loyal customers – and rightly so.

For instance, Binance US charges fees for trading and withdrawals; Binance US determines the fee schedule depending on users' 30-day trading volume, which is calculated on a rolling basis everyday at 8pm EDT, and the fees also change depending on the token.

As an example, when withdrawing Alorand (ALGO) on the exchange, users will be assessed a fee of 0.01 ALGO on the Algorand chain, yet it will cost users 0.00104 ETH to withdraw the same amount of Ethereum on an ERC-20 network.

Although this may seem like a strange variation, other exchanges have similar structures due to demand and fluctuations in gas price.

Although, despite offering low trading fees for most things on the platform, Binance US does charge a relatively high fee compared to its rivals for debit card deposits, a whopping high fee of 4.5%.

In this case, users would be much better off depositing money through a wire transfer or ACH, which are free when they are domestic transfers.

Comparison

Binance US is a powerhouse in the US markets. It is Binance's successful attempt at creating an entirely separate company from the main behemoth sized company that we all know and love (mostly). Binance US can definitely be compared to Coinbase for example, one of the largest players in the US market. Binance US offers much more attractive fees than Coinbase, as well as a more advanced user interface for trading (this can be considered a 'con' if you're a newbie), and has about the same amount of trust that Coinbase has from it's own community. Coinbase does win the battle when it comes to ease of use and customer support, these are two areas it just simply can't be beaten in.

This is why CoinScan recommends that Coinbase be your introductory exchange to get into crypto, and then once you become more advanced and well versed in the space, exchanges like Binance US are a great platform to explore and continue growing.

Safety Essentials

Security

There have been no reported breaches regarding Binance US. However, the parent company, Binance, had $40 million worth of bitcoins stolen in 2019, alongside another $750 million tokens stolen in 2022. Thankfully for Binance International, the exchange had enough measures in place to pay back all affected users.

To ensure extra security, Binance US advises all Binance users - including users around the globe, whom are members of its parent company - to use its official wallet for holding cryptocurrencies, dubbed Trust Wallet.

Users can easily download the high-rated wallet on Google Play and the App Store. However, all users are welcome to use other wallets, whichever their preferred choices may be – with many defaulting to the industry standard, MetaMask.

Other security features offered by Binance US include requiring that the exchange verifies all users identity (via passports or driving licenses) before allowing users to buy, sell or trade crypto.

Once Binance US accepts the identity verification process - which can take a hot minute - members are able to go through the final steps of the KYC process, before setting up multi-factor authentication, with facial recognition being an option for extra security purposes.

To continue their flawless reputation as one of the few crypto exchanges that have never faced a security breach, Binance US utilizes a system of cold wallet storage due to hacking of cold wallets being harder to execute.

In addition to this, if such an unfortunate event were to occur, Binance US keeps 10% of all trading fees in a secure fund to pay for any damages and affected users in the event of a breach.

Controversy

Binance US was formed by its parent company, Binance (international), in 2019 following an investigation by the US Commodity Futures Trading Commission (CFTC) for potential crimes including money laundering and tax evasion.

While Binance International has had a difficult relationship with regulators across the globe, the exchange has hired numerous compliance staff following US authorities investigating Binance.

Although no charges have been brought as of now, there remains outstanding issues with the issuance of BNB as a potential unlicensed security. Although Binance US is different to Binance International, they are intimately related on the public stage.

Following more regulation concerns, Binance moved from China to Japan in 2020. However, Binance US has yet to have an exact home for its headquarters. CEO Changpeng Zhao, made light of the remote situation at a tech conference in May 2020, stating that

“Bitcoin doesn’t have an office”; thus, why does Binance US need one?

Despite being dubbed Binance US, the platform is not available to all US states. At the moment, the crypto exchange is unavailable in the following states:

Another issue affecting Binance's reputation is being a target of hackers. Although Binance US and Binance were separate entities at this point, the parent company suffered a significant hack in 2019 that resulted in losses of $40 million worth of BTC.

A few years later, the world’s largest exchange was targeted again in October 2022, costing the platform more than $570 million.

As of Jun 17th, 2023 there was also a notice that the SEC was going after Binance US for selling securities. This forced Binance US to make drastic changes to the platform, such as not allowing users to offramp US dollars to their bank anymore, and other changes. More can be read about it here on Binance US's official tweet response. <blockquote class="twitter-tweet"><p lang="en" dir="ltr">We want to provide an update on the current battle <a href="https://t.co/AZwoBOh0gq">https://t.co/AZwoBOh0gq</a> finds itself in with the SEC. We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our platform which was clearly unjustified by both the facts and…</p>— Binance.US 🇺🇸 (@BinanceUS) <a href="https://twitter.com/BinanceUS/status/1670077275419869186?ref_src=twsrc%5Etfw">June 17, 2023</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>

Proof of Reserves

Alongside the absolute travesty that was FTX, many crypto exchanges are presenting Proof of Reserves to prove that they are fully collateralized with all user funds, not engaging in risky trading strategies, or providing loans with user deposits.

Following this practice, Binance provided an audit report by Mazars, to prove that it does, indeed, hold all users' funds in reserve – however, some analysts have scrutinized this report as not being detailed enough.

It has also come out that Mazars has stopped working with crypto clients entirely, no longer publishing proof-of-reserves audits.

It is important to note that sister site Binance does now show full proof of reserves for anyone to see via its own CoinMarketCap, the US version has not – as yet – emulated this transparency.

That said however, Binance US is fully regulated by the United States, and no US-regulated centralized exchange has ever gone down in a similar manner to FTX…yet.

Conclusion

Binance US is a strong and heavily-regulated exchange that is separate from its parent company, Binance, despite sharing a name. After splitting off in 2019, the regulations imposed upon it by the US government have, most likely, prevented any US-regulated exchange including Binance US, from having issues similar to FTX.

These same regulations and the patchwork of laws throughout the US make it unavailable to residents of New York, Hawaii, Texas, and Vermont.

Although Binance US offers lower trading fees compared to many of its competitors that also focus on the American market, it only provides a limited selection of digital assets for buying, selling, and trading purposes.

As a result, other exchanges may appear more appealing from an asset diversity standpoint.

Although it's essential to consider security risks, the cryptocurrencies available at Binance US include the top 20 cryptocurrencies by market cap, such as Bitcoin (BTC), Ethereum (ETH), BNB (BNB) Dogecoin (DOGE), and many more.

Sites that offer too many coins – like the exchange KuCoin, for instance – face criticism due to listing coins that are not established and from immature projects, increasing the risks of their users.

Binance US instead clearly takes a quality over quantity approach – although perhaps a step too far. As an additional differentiator from other US-based exchanges, the BNB token allows discounted trading fees on the Binance US platform to the tune of 25%, encouraging not only active traders to buy and hold BNB, but to use the exchange for their trading needs.

While this token has come with some controversy in the USA regarding it being a potential unlicensed security, individual holders have little or no risk by utilizing the token in order to make their trades on the platform.

Binance US, like most other exchanges, often receives negative feedback from users on third-party sites, specifically about issues relating to the support system and time to resolution.

The issues reported typically include problems with the exchange’s; deposits, trades, and withdrawals. Positive feedback usually praises low fees and ease of use.

Overall, Binance US can at least be seen as one of the safest exchanges on the market, due to the sheer size and power of the ecosystem it's connected to – and that will be enough for some traders – however, in terms of actual daily use, it falls short in comparison to many of its contemporaries.