Bybit

Bybit Review 2023: An Expert's Comprehensive Analysis

4.2

4.5

4

4

4.2

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Great coverage in multiple countries

Robust selection of vetted tokens and established projects

0% spot trading incentives

Demonstrated proof of reserves

Cons

Some of the coins listed are not as established, so may be at higher risk

The exchange is not licensed or available in the USA

Key Takeaways

Origins

Introduction

Established in 2018, Bybit prides itself as one of the most innovative, fastest-growing cryptocurrency exchanges in the cryptosphere.

Despite not offering its services in many countries such as;

the exchange still clocks in at more than 10 million users – most of whom are more sophisticated retail and professional clients, rather than crypto novices – thanks its low fees and state-of-the-art features ideal for active trading activity.

But does it deserve its accolades, or is it a Bit Con? Join Coinscan as we find out everything there is to know about Bybit!

History

Following in the wake of exchanges that launched during the 2017 bull-run, Bybit was a little late to the party, getting going in March 2018. Bybit’s Chinese-born CEO Ben Zhou oddly chose to headquarter in Singapore, despite them being openly anti-crypto and the service not being available there.

Before starting Bybit, Zhou had a wealth of experience in blockchain and Forex. He began showing an interest in all things crypto-related all the way back in 2016 while formerly working at XM - one of the world’s largest Forex trading institutions and an early institutional adopter of cryptocurrencies.

When first exploring the crypto industry, Zhou could see that the industry was brimming with potential to disintermediate established and extractive financial institutions.

As a result, he took to YouTube to start his own channel to educate others about the burgeoning industry and its benefits. He continued running this channel until the launch of ByBit, and eventually let it fall completely by the wayside as the burgeoning exchange took an expanded role in his life.

Since inception, the crypto firm has helped millions of users trade and save trading fees compared to other exchanges floating around in the cryptocurrency exchange industry.

As the platform began developing a name for itself, more established partners have come on board, including big names such as Chainlink, Circle, Fireblocks, and Paradigm. While all Web3 companies take pride in partners and community, Bybit’s extensive list of partners shows that the firm is playing its cards right.

Following their plans for global expansion, in April 2023, Bybit moved its headquarters to the Dubai World Trade Center.

User Experience

Ease of and Design

Traders appear to enjoy the simplicity of ByBit first (which is similar to Binance’s in design), however upon digging further, problems regarding terminology and education may arise.

The crypto-related buzzwords featured on the website can soon become confusing for many users who aren’t familiar with DeFi, which necessitates research in order for users to get the most out of Bybit.

Following on, although the platform may initially seem confusing for some, once establishing the know-how, it has numerous straightforward one-click features for trading, market depth and more.

Users can also easily access a comprehensive commission policy alongside demos to clarify trading logistics and regulations for beginners.

Usage and Popularity

Despite not having as many active trading pairs and supported cryptos as other exchanges Bybit still features a respectable 445 coins and 665 pairs.

The coins on ByBit tend to be from more vetted and established projects, unlike many lower rank exchanges, which are often loaded with questionable tokens and young projects.

Some of the crypto exchange’s most traded cryptocurrencies include established stablecoins including Tether’s USDT and the industry king, Bitcoin (BTC).

This comes as no surprise, as almost every offered coin is traded against USDT, and BTC remains the crypto market’s undisputed leader in market cap, interest, and cultural adoption.

Statistics show that Bybit is up there in terms of reputable exchanges. After the collapse of FTX International, Bybit saw a significant amount of increased trading activity, with extreme daily swings of $2.2 billion all the way up to $9.22 billion.

Customer Support

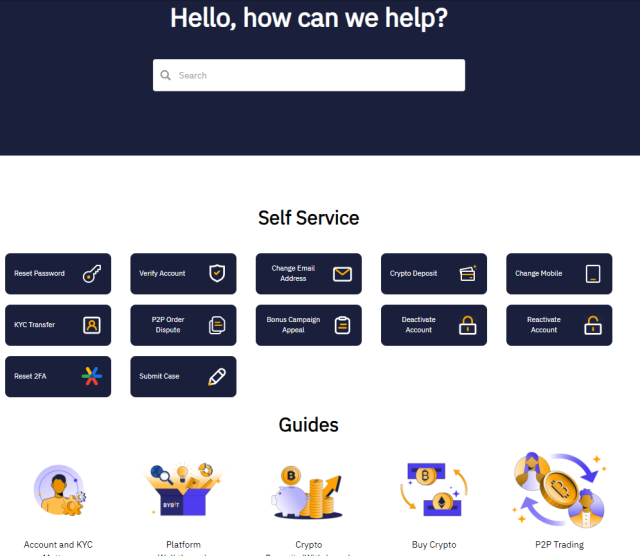

Bybit is another crypto exchange that has attempted making customer support its number one priority.

The exchange has a 24/7 customer support team on call to answer all phone calls across the globe and a live chat function to help resolve any queries or issues promptly.

Nevertheless, it’s typically difficult to instantly get through to someone from the customer support team via the phone.

The language options for both customer support services are English, Chinese (Cantonese and Mandarin), Korean, Russian, Japanese, Spanish, and Vietnamese – an interesting choice considering citizens from mainland China are banned from using the platform, alongside those in North Korea.

Depending on the queries, customers can also contact support via these addresses:

Customers will receive an automation email alongside a case number. Customer support will then respond within 1-3 working days.

Alternatively, similarly to many other crypto exchanges, Bybit's LiveChat support is accessible on the platform by clicking the support icon on the bottom right, and should provide much faster answers to most users questions.

However, like many of these features alike, it can be hard for the tools to pinpoint the exact issues. Thus, customers usually find it easier to directly contact a member of the team, rather than a robot.

Fees and Promotions

Fees

Like many other exchanges, ByBit charges for spot trading fees at a rate of 0.1% for both maker and taker, which is still more generous compared to most platforms. VIP members see fees decreasing potentially all the way down to .005%/.02% for trading spot.

Moreover, like many other crypto exchanges, Bybit offers staking as an incentive for users to earn passive income. Although some coins require to be held for a certain amount of time for rewards and higher yields, many are available to be staked and unstaked at will.

Bybit takes a staking fee of 0.075%, which is significantly cheaper than the exchange powerhouse Binance, which charges a staking fee of 10%.

Another fee Bybit cannot dodge - like all other crypto exchanges - is gas fees, which are established by the blockchain networks themselves. While many networks charge negligible gas fees, the Ethereum and Bitcoin networks specifically can, on occasion, charge ridiculous gas prices following network congestion.

Bybit, like all other exchanges, pass these fees onto you when depositing or withdrawing. An excellent example of past congestion is when Yuga Labs’ “Otherdeed of Otherside'' NFTs on the Ethereum blockchain was in such high demand that buyers ended up paying more than 2 ETH to ensure transactions went through - accounting to a whopping total of $179M in gas fees.

The exchange also charges less than Binance and Coinbase for subscription, redemption, and management fees, at just 0.5%. Binance and Coinbase charge a fee of 1% for these privileges.

Overall, compared to the crypto exchange giants Coinbase and Binance, Bybit comes in tops in terms of low fee structure.

Comparison

Bybit overall is a very solid choice for users looking to dive into a new crypto exchange. Bybit has a really good, easy to use design that offers a lot of features besides just regular spot trading.

Additionally, Bybit also has a very impressive and above average selection of cryptocurrencies listed on their platform, making it a great choice for users looking to diversify and start exploring the vast world of crypto! Bybit and Binance have a lot in common, almost as if Binance was the 'big brother' to Bybit. They were both founded in 2018, they have very similar fees, and a great customer support team.

The differentiating factor in our opinion comes down to Bybit having one of the best mobile UI's for traders on the go, as well as a great leverage trading functionality that at first glance is very simple to use and understand. Binance's is slightly more complicated.

Both exchanges report massive daily volume in the billions, of course Binance is king here at about 4-5 times the volume of Bybit, but still almost $4 billion in daily volume is nothing to scoff at! The other nice advantage Bybit has is the lack of a KYC requirement needed to start using the platform, including leverage trading. If you are a true believer in decentralization, you will likely really enjoy using Bybit.

Safety Essentials

Security

Unfortunately as blockchain matures, there are many people who are put off by the growing industry’s seemingly endless hacks and breaches, lack of regulation, and high barrier to entry, including knowledge about wallets, private/public keys, and massive news stories such as the collapse of FTX International.

Following FTX epically failing to put the correct security measures in place, many crypto exchanges have done all they can to prove their trustworthiness. Bybit’s answer is to spend 20% of its annual budget toward ensuring its platform is secure.

Like many other exchanges, the platform also secures much of its crypto holdings in “cold wallets”, in order to ensure its platform’s holdings are accessible and segregated in case of a breach of the website or platform itself.

Cold wallets have robust security advantages, features, and management processes to make sure that user and platform funds are not able to be compromised in case of a breach. All of these processes are in line with its privacy and security policies stated on Bybit’s platform.

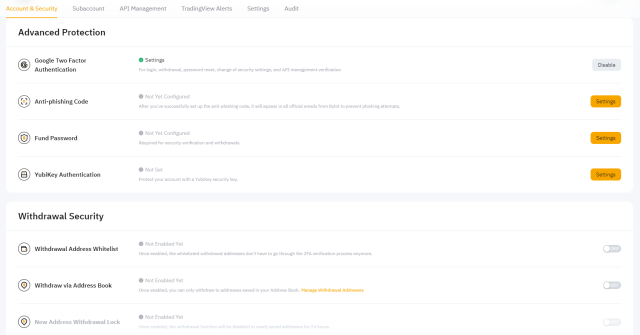

Furthermore, this exchange implements industry standard two-factor authentication (2FA) to prevent hacks or compromise of user accounts.

Therefore, to have the ability to access the platform, users must scan the QR code to set up a 2FA, and type in the six-digit 2FA code randomly generated by an app such as Google Authenticator or Authy. Users will also have a recovery key phase they must write down and keep in a safe place if prompted regarding suspicious activity.

As you can see, Bybit takes security very seriously - similar to Binance and Coinbase, which also require 2FA for access. Better still, Bybit also carefully evaluates each withdrawal request and partakes in a bug bounty program that invites white-hat (ethical) hackers to alert the company of any security flaws.

By providing significant bug bounties, Bybit incentivizes potential hackers to legally claim rewards from the platform for ethical disclosure, rather than potentially suffering a security breach that would drive confidence in the platform down.

Unlike other competitors including Binance, which faced a Bridge hack worth a whopping $570 million in October 2022, Bybit has dodged all potential hacks by taking several precautions to ensure optimal trading security including those above.

For example, one of its features that secure the platform, which both Binance and Coinbase do not include, is that users can only withdraw three times per day from an account, regulated by the account limits per user. Thus, hackers are prevented from instantly draining their victims dry.

Currently, there are numerous types of KYC levels. Those who do not complete KYC can withdraw 20k USDT daily and a monthly limit of 100k. KYC level 1 members can withdraw $1M UDT with no monthly withdrawal limit, whereas KYC level 2 and Business KYC members can withdraw $2M USDT with no monthly withdrawal.

Nevertheless, members not needing to be KYC registered to withdraw 20k USDT per day and 100k per month came as a surprise especially considering it is required for all Binance and Coinbase customers in the US.

Controversy

Despite Bybit being lucky enough to dodge all potential hacks, it had to recently lay off 30% of its workforce following the FTX aftermath - despite already laying off a significant amount of workers at the beginning of the year due to unfortunate market conditions.

The most prominent reason for the most recent layoff includes panicked traders over FTX taking their funds from crypto exchanges and putting freezes on withdrawals following liquidity issues.

This being said, all exchanges worldwide have taken a beating in 2022, alongside NFT and crypto projects. So, technicalities and features behind Bybit are not to be blamed.

The exchange also does not offer its services or products to users in the following excluded jurisdictions:

It also reserves the right to terminate its services in any other jurisdiction following political or legal issues.

Proof of Reserves

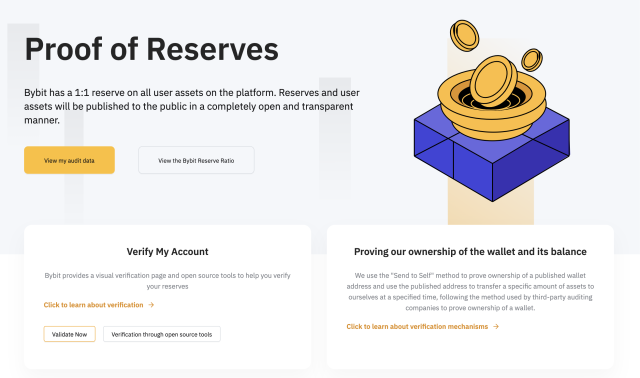

To prove its trustworthy source in a volatile and recently spooked market, Bybit publishes its Proof of Reserves on its platform, including verifying its wallet and balance ownership.

To do so, Bybit provides users a “Send to Self” method which gives users proof of the company’s wallet address alongside transfer addresses used numerous times.

In addition, to outride other security concerns, the crypto exchange firm provides its users with a visual verification page and open-source tools to help verify reserves on the platform.

By implementing such tools, users can see that Bybit holds their customers' assets rather than transferring them to third parties – proving they are token holders of personal assets if anyone has any questions regarding their tokens' whereabouts.

Conclusion

Following this review, Bybit is undoubtedly a dynamic and efficient trading platform for anyone who is interested in safely accessing the crypto market and pursuing trading activities.

Despite being a little confusing for crypto novices at first glance due to its crypto-jargon and offered technical trading features only enthusiasts would know, it’s worth beginners educating themselves into the jargon in order to use the exchange to save money on fees.

Similarly to its competitors, Binance and Coinbase, Bybit has multiple trading options, a fair (and cheaper) fee structure, round-the-clock customer support, and is safe, secure, and transparent with proof-of-reserves readily available.

Considering the exchange already rakes in 10 million users worldwide, the platform would reach even higher heights if it were to offer its services to the US, mainland China, Singapore, Quebec and Ontario in Canada, North Korea, Cuba and other restricted jurisdictions that are currently banned – potentially overriding its competitors all together.

Although, it may want to consider adding more trading tokens and opportunities to its platform to achieve such goals.