Coinmetro

Coinmetro Review 2023: An Expert's Comprehensive Analysis

4

3.75

4

4

4.25

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

No leverage

A small range of tradable assets

No staking programs

Cons

Simple, modern design with an easy-to-use interface

Strong security credentials

Efficient and secure mobile app

Great customer support

Key Takeaways

● Simple and intuitive interface

● Lots of market instruments

● Rapid growth with greater potential

● Low volume and low variety of cryptos

Origins

Introduction

Next up in our review crosshairs for our exchange deep dive series is Coinmetro.

The Estonia-based exchange offers services beyond a regular exchange with its own trading terminal that enables extensive functionality and built-in analytics.

On the platform, users are offered advanced trading services such as margin trading, Swaps, Copy Trading, and a Digital Securities Marketplace.

But how does the service buffet work in reality, and is the exchange a hit or a miss? Join CoinScan as we head in to find out!

History

Coinmetro’s story began in 2018 when Kevin Murcko (Founder & CEO) established the company in Estonia- setting it on a mission to ensure everyone, everywhere has safe access to life-changing opportunities in the digital world of blockchain technology and cryptocurrency.

Mr. Murcko is a known face in the retail foreign exchange world, with his pioneering company FXPIG bringing transparency to retail FX- garnering him the unofficial title of one of the most transparent CEOs in the financial industry.

Coinmetro started on a high note, raising a total of $13 million through an initial coin offering (ICO) in April 2018. Since its establishment, the company has raised a total of $18 million- giving it a market valuation of $180 million.

In May 2019, the company launched its own ERC20 utility token and native cryptocurrency, XCM.

The utility token, issued within the exchange’s platform, helps facilitate payment services carried out on the platform- in line with its mission to be a fully-rounded Fintech ecosystem designed to simplify access to the digital asset economy.

Boasting a fourfold year-on-year increase in the number of users, Coinmetro is one of Europe's fastest-growing cryptocurrency exchanges. Today, the full-service crypto exchange has a license to operate in the European Union, the United States (woop), Canada, and Australia.

User Experience

Ease of Use and Design

In terms of user interface (UI), Coinmetro is a cut above many of its peers.

The simple, modern design makes the user experience a breeze. The platform has been designed in a very interactive and practical fashion- and the website graphics display not just a modern design but are also stylish and appealing to the eye.

Another important design feature is that the website is well-suited for all types of traders, both beginners and experienced.

Other than the easy-to-understand dashboard making the whole trading process incredibly easy for any trading level, the exchange’s margin trading platform is also quite solid - earning it praise from many experienced crypto traders.

Coinmetro claims that its attention to customer-first features and intuitive interface helped it achieve a 300% growth rate in the U.S. between 2021 and 2022 alone.

The website also comes in 3 different languages:

This is a great approach by an exchange with a global ambition.

Additionally, users have the option to choose to either trade via the web-based platform or the mobile app version, available in both iOS and Android.

Of course, those who love to trade on the go will choose the latter.

Usage and Popularity

Aiming to “redefine the industry in the age of crypto”, the exchange has set up a variety of different services and features for its users, with some of the most popular ones being:

Spot trading is by no means the most popular service on Coinmetro - with beginner traders preferring it due to its simplicity.

Margin trading, on the other hand, is preferred by experienced traders as it is a high-risk type of trading that has the potential to give high rewards and gains (but can also lead to bigger losses).

The exchange has also gained huge recognition from its copy trading feature.

Copy trading is a feature that allows traders to invest a certain amount of money into “mimicking” the trades of mostly experienced traders.

This feature is highly appealing to beginner traders because they don’t need to have extensive knowledge to make potential profit.

To help copy traders even further, Coinmetro has vast information about each professional trader on the platform, including individual records on win/loss ratio, trading history, and general qualification. Nice stuff.

The exchange’s other widely popular offers are staking and Bug Bounties- packaged under the “Earn” offer.

The staking feature saw the exchange release the first-ever Quant staking platform in December 2020. Users can deposit QNT (the native token of Quant Network) into their main wallet to start earning Quant staking rewards without having to opt-in or lock something- and the rewards accrued are paid out in XCM.

Bug Bounty program, on the other hand, rewards users who are able to identify any kind of security flaw or vulnerability in the platform and its network.

The platform also allows users to invest in digital securities (security tokens) – apparently, the first-ever European exchange to provide this service. With this investment type, the exchange opens up more opportunities for investors to claim stakes in the issuing companies’ profits and dividends.

Many investors prefer digital securities over traditional securities because the former allows for immediate settlement and free access to interesting projects.

The exchange’s fiat gateway is also an important feature to point out. Coinmetro is one of the few platforms offering all the major fiat currencies in order to achieve quick and easy fiat transfers.

Users can deposit and withdraw:

Also trade a bunch of different fiat trading pairs, with the supported deposit methods including wire transfer, debit card, SEPA transfer, UK faster payment, instant ACH and crypto deposits.

The multiple deposit options, alongside fiat deposit, makes the exchange a perfect destination for first-time traders wanting to experience the thrill of trading digital assets.

The cryptocurrencies supported may not be that extensive, but the exchange has in its list some of the most popular digital assets such as BTC, ETH, XRP, and BCH among others.

Through the latest funds raised, the exchange also intends to add new services such as passive-income products to help customers mitigate the impact of high inflation and interest rates. These additional products and services are likely to help the exchange reach new heights as far as growing its user base and trading volume are concerned.

Coinmetro is licensed to operate in EU countries, the U.S., Canada, and Australia, and the exchange has set up brick-and-mortar offices in Estonia (headquarters), Hong Kong, Mexico, and Australia.

On the downside, at the time of writing, the exchange has just 67 coins and 144 trading pairs on its platform- reporting an average daily trading volume of $875,000. Its most active trading pair of BTC/USD returns a daily trading volume of $335,000.

The trading volume is undeniably low compared to many of its peers, which may explain why the exchange is working hard to grow its operations in Europe and the United States to ramp up its numbers and compete with the big boys.

Customer support

Coinmetro has outdone most of its competitors with comprehensive customer support.

First, the exchange has an ever-growing database of articles, which include topics from Getting Started to Trading Platforms, Education, and much more. Users can also get answers to their queries from the Help Center articles.

There are two primary ways of reaching customer support: email and Live Chat support- available 24/7. This makes the exchange one of the best-performing exchanges in terms of customer support - and the hard-to-please crypto online community have taken notice- giving it some of the rare rave reviews.

Unfortunately, though, the exchange does not provide telephone support (but you know, who does?).

Fees and Promotions

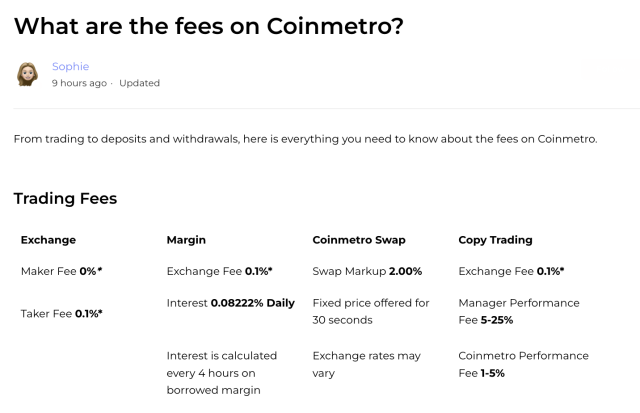

Fees

The value of trading fees can never be overstated, as it eats into the potential profits of traders.

Coinmetro, just like most exchanges, uses the standard taker/maker fee model. The exchange has some very competitive trading fees, with Spot traders paying a 0.10% taker fee.

But what makes trading on the exchange even juicier are its zero percent maker fee.

Considering that the industry average is 0.20%- 0.25%, this is a big score for Coinmetro in its desire to wrestle the big players like Coinbase and Binance in the crypto exchange arena.

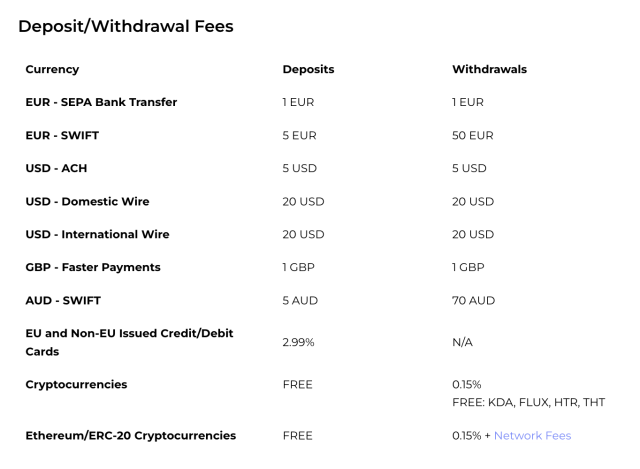

The exchange doesn’t charge users to deposit crypto. However, depositing USD via ACH will attract a fee of $5, while depositing with domestic and international wire transfers attracts a $20 fee.

In terms of withdrawal fees, the exchange has set a percentage-based withdrawal fee of 0.15%. This withdrawal fee model is as potentially costly as it is unusual (most exchanges charge a fixed withdrawal fee, irrespective of the amount withdrawn).

The percentage-based withdrawal fee model is therefore only suitable for traders withdrawing small amounts. For example, withdrawing 0.01 BTC will only attract 0.000015 BTC – a negligible charge..

For large withdrawals, however, this fee model is grossly disadvantageous, since withdrawing 10 BTC will attract 0.015 BTC, an extremely high fee.

It is fair to say however, that this choice of withdrawal fee model could be a strategy by the exchange to keep the platform’s liquidity high- with high withdrawal fees for large amounts acting as a deterrent to traders initiating withdrawals.

Comparison

Now lets take a look at how Coinmetro stacks up against another competitor with a similar business model and practices, Delta.

Now lets review what sets them apart from each other;

If you are looking for an exchange with a wide range of trading features, a high daily trading volume, and support for more fiat currencies, and you do not need GBP or CHF support, then Delta is a good option. If you are looking for an exchange that is focused on European investors and supports GBP and CHF, then Coinmetro is the better option.

Safety Essentials

Security

Another feature that can define an exchange’s success or failure in a big way is its security.

Coinmetro has all the primary security features in place, starting with the proof of their Estonian license displayed on the website – highlighting the emphasis the exchange puts on regulation as a means of ensuring users get a secure and safe trading experience.

To ensure the personal information of their users is secure, the exchange encrypts all the data on its platform. In addition, they use a 2-factor authentication (2FA) system, email verifications, and “captcha protection” to add a layer to the security protocols.

The exchange also implements a KYC procedure to respect rapidly evolving international regulations and to protect itself as well as its users. The security protocols may not be as elaborate as those of some competitors; however, they are sufficient enough to cover the safety of the exchange and its users.

Controversy

Coinmetro hasn’t had any significant controversy to damage its image. The only case even worth mentioning is the recent rumored allegation that the exchange was involved in a tax evasion scheme.

However, the exchange responded immediately to the rumor, refuting the claims and assuring the public that they have had talks with the Estonian Tax and Customs Board (ETCB) for months and that the company was not being investigated for any tax fraud.

Proof of Reserves

There is no substantive evidence to suggest that Coinmetro has undergone proof of reserve auditing to confirm its assets on hand (liquidity backup).

This is despite the importance of the latter in ensuring users’ deposits are backed up with enough liquidity.

The exchange can do better to improve its transparency and reliability score here, especially now that they are working to grow its global market reach.

Conclusion

Coinmetro has been operational for a relatively short amount of time; however, the exchange has made significant strides during that time.

This is attributed to its high functionality, wide range of investment instruments, great trade fees, impressive security protocols, and transparent business activities. However, users do need to be mindful of the potentially high withdrawal fees.

The exchange is still evolving with a host of fundraising series planned, so it will be interesting to see how they grow over the coming years.

Overall the exchange has a lot to offer for both beginner and experienced traders, so it could well be worth a spin.