Indodax

Indodax Review 2023: An Expert's Comprehensive Analysis

4.1

4

3.75

5

3.5

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Efficient security procedure

Decent learning tools

Lots of crypto assets and trading pairs on offer

Great customer support

Licensed exchange

Cons

No demo accounts for beginner traders

Supports only one fiat currency (IDR)

Key Takeaways

● Simple design fit for inexperienced traders- not sufficient for experienced expert traders ● Excellent customer support ● Primarily targets the Indonesia market

Origins

Introduction

Next up in our crosshairs for the top 100 exchanges is Indodax, Indonesia’s giant digital asset trading platform.

Arguably the largest cryptocurrency exchange in Indonesia, Indodax is known for its large number of registered users, primarily in Indonesia.

The exchange’s business model suggests a platform whose strategy is targeting the larger Indonesian market through the ease at which traders can execute Indonesian Rupiah (IDR) deposits – apparently the only supported fiat currency.

But what else makes Indodax tick? Is it ease of use and design, trading and transaction fees, security, or customer care? All, or none of the above? Join us at CoinScan as we dig deep to find out!

History

Indodax’s journey into the business of digital asset trading began in 2014 when it launched as Bitcoin Indonesia- a name it would drop in 2018 to adopt the new name, Indodax (Indonesia Digital Asset Exchange).

The reason behind the name change was simple: the fast-growing crypto industry was not just about Bitcoin, and as such keeping the word “Bitcoin” in the name made the platform sound too narrow in terms of digital assets on offer- despite the introduction of a highly diversified buffet of crypto assets.

The founders, Oscar Darmawan and William Sutanto envisaged the growing need to adapt to a new crypto trend by diversifying its portfolio of digital assets.

In his own words, the exchange’s CEO Oscar Darmawan stated that:

There are still many people who know us as a payment system using Bitcoin. In fact, our goal is not as a payment system.

This then became one of the reasons for this name change. Indodax aims to provide more services and support to users. In this rebranding, nothing has changed in terms of the system, structure, and method of membership.

Today, the platform is estimated to serve more than 5 million users spread across 40+ countries. Not bad growth at all.

User Experience

Ease of Use and Design

Another significant feature for any competitive trading platform is its ease of use and design. First is registration on the Indodax platform, which is pretty standard and straightforward KYC: Users just have to provide a unique username, email, password, and phone number. (The latter must be from a country supported by the exchange).

The registration process is only considered finished if KYC verification is completed, so users must do this before being allowed to use the exchange.

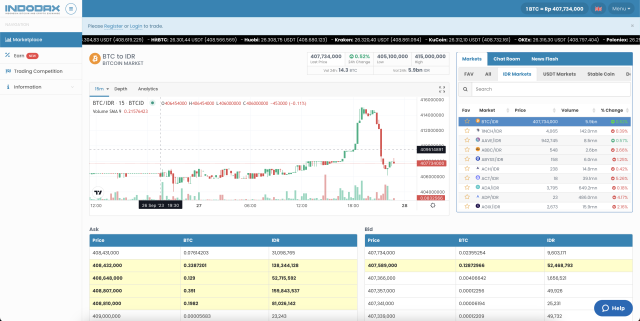

Indodax’s user interface looks pretty organized- displaying different sections like Marketplace, wallet, Buy and Sell Bitcoin instantly, Account verification and Google Authenticator.

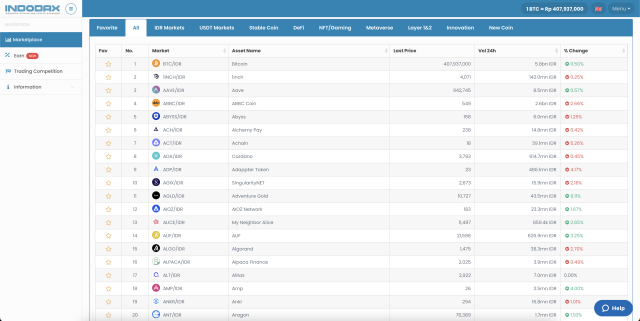

The marketplace section of the trading view also presents users with various cryptos, corresponding prices against IDR, and volume and percentage price changes in the last 24 hours. However, the interface is most likely still too simplistic for expert traders.

For those looking for a digital wallet to store their funds, Indodax has a centralized wallet where a trader can hold their IDR or any digital currency supported by the exchange. It’s a pretty decent wallet, except that we cannot recommend a centralized wallet for our readers.

A good thing then that traders get full custody of their digital assets, so we would recommend opting for a decentralized or cold wallet. On mobile accessibility, Indodax’s web-based platform is mobile-optimized, which means users can access and execute any trading activities supported via their mobile devices. The exchange also has a mobile app (available on both iOS and Android)- making trading on the go a breeze. Overall, pretty good stuff here.

Usage and Popularity

Indodax offers a variety of features and services to its users- top among them is the instant buy-and-sell feature. The ability to instantly buy and sell cryptocurrency with IDR is seen as the exchange’s biggest selling point. Indeed, Indodax was the first exchange based in Indonesia to offer instant buying and selling of Bitcoin.

How about the supported coins? Well, as the original name Bitcoin Indonesia suggests, the exchange mainly focused on Bitcoin when it entered the market in 2014- but over time started supporting other cryptocurrencies. Today, the exchange supports dozens of altcoins and tokens, including popular coins like:

For deposits and withdrawals, Indodax supports both fiat and crypto deposits. However, the only supported fiat currency deposit is IDR. This could be a downside for its international users who have to convert their respective local or regional currencies to IDR to be able to deposit funds- a process that will certainly add to the overhead costs in the form of currency conversions.

Meanwhile, for crypto deposits, a digital wallet is needed- with popular choices being Metamask, Trust Wallet, Coinbase Wallet, DeFi Wallet, and Argent. For withdrawal, the platform supports both fiat and crypto. Again, as with deposits, the only fiat currency available for withdrawal is IDR, so users can expect to pay more to convert IDR to another currency like USD. Just like most crypto exchanges, Indodax does support wire transfers, but no credit card or bank transfer deposit- and the same applies to withdrawals. It is also possible to deposit and withdraw using a digital wallet- which makes it easy to have full custody of the withdrawn amount once it hits the wallet. The exchange does not have any limit on withdrawal for Indonesian account holders; however, foreign users are subjected to the withdrawal limit of 10,000,000 IDR per day. Indodax is currently available in more than 40 countries, excluding the U.S. market – which is no huge surprise due to their complex trading laws and regulations. While many exchanges have existing or are launching native tokens, Indodax does not have a native token- something that could have potentially helped it grow its user base. Still the popularity of Indodax is still more than acceptable if the available statistics are anything to go by 2021 data from Statista.com indicates that there are over 11 million registered crypto investors in Indonesia- and Indodax is estimated to have over 5 million users on its platform across the globe, which is a pretty sizable slice of the pie.

So far, Indodax has over 289 coins and 304 trading pairs on offer- with a reported average daily trading volume of $12.5 million. The most active trading pair is USDT/IDR with an average daily trading volume of $4.4 million (Not bad stuff, considering the exchange primarily focuses on a single market- Indonesian crypto users).

Customer support

Customer service is a crucial but often neglected aspect of an exchange. In this regard, Indodax has hit a home run.

Firstly it has its customer support available 24/7- with claims of the live chat being available even during holidays, which is a nice touch. What’s even more impressive is that the exchange seems to offer all the possible means to reach their support team: email, phone numbers (which is worth its weight in Bitcoin), and Live Chat support.

The exchange currently supports three languages: Indonesian, English, and Chinese. Reports are that customer service is responsive, helpful and well-equipped to handle issues.

Overall, the exchange has aced this area, and just need to keep it up.

Fees and Promotions

Fees

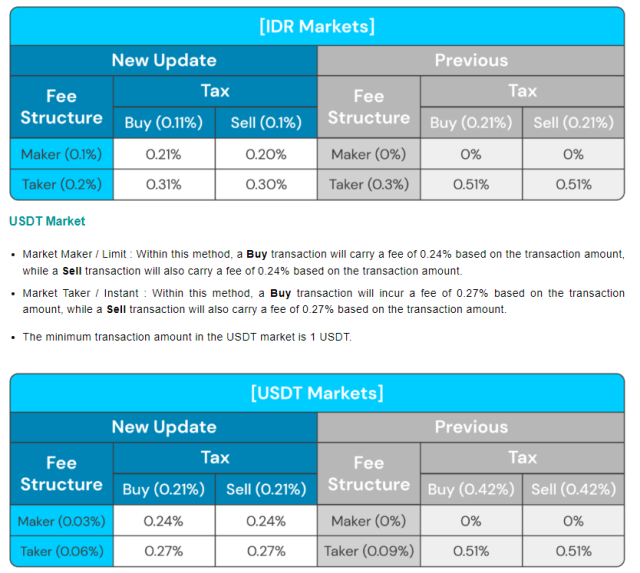

Exchanges are always looking for avenues to one-up their rivals, and competitive fees are a great way to do this. With good reason too, as the first thing a trader is likely to look for before trading is the cost of using any exchange. In this regard Indodax does fairly well, but nothing special. The platform – just like most exchanges – applies the maker/taker fees model. Based on this model, Indodax charges 0.03% maker fees, while takers are charged 0.06% (around the industry average).

For deposits, the exchange does not charge any fee for crypto deposits. However, depositing fiat currency (IDR) will cost a 1% deposit fee. On withdrawal, fiat withdrawal is 25,000 IDR for any transaction less than 100,000,000 IDR. For withdrawals above 100,000,000 IDR, a trader is expected to pay a withdrawal fee of 100,000 IDR. For crypto withdrawals, the fees will vary from one crypto asset to another. For instance, the fees for withdrawing BTC are set at 0.0005 BTC. To conclude- except for the Bitcoin withdrawal fee which is below the industry average- the overall fees on Indodax can best be described as middle of the road.

Comparison

Lets pit Indonesia vs Estonia in a battle for crypto exchange supremacy. Coinscan will see how Indodax stacks up against Emirex, and go over the similarities and differences between both;

Here are some of the key differences between the two exchanges;

Retail investors in Indonesia looking for an exchange with high daily trading volume and support for IDR will find Indodax to be a good option. If you are an institutional investor looking for an exchange with a wider range of trading features, including futures trading, then Emirex is a great option.

Safety Essentials

Security

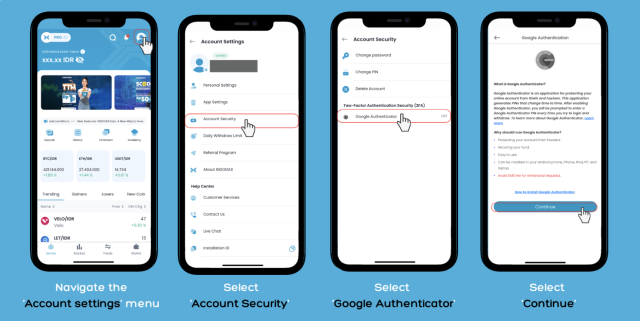

The exchange’s security features can be described as basic but efficient- as the exchange has employed every primary security procedure it can to secure user accounts. As such, the main security procedures at Indodax are the 2-factor authentication (2FA) requirement, and email and SMS- verification. These features ensure no unauthorized third-party access to user accounts and execute any transaction without the account owner’s knowledge.

That’s just about it for Indodax’s security procedures- at least what they report anyway. It appears basic but efficiently executed. The exchange has never been hacked (yet) so does show that the security procedure is seemingly well implemented.

Controversy

The crypto space is abound with controversy and scandal, and most exchanges unfortunately don’t hold up to scrutiny in that regard. For Indodax, there was one lawsuit filed against the exchange in July 2020 in a U.S. court. In the lawsuit, Dennis Nowak – a German resident – accused Indodax alongside another exchange Xapo- of harboring close to 500 stolen bitcoins. Mr. Nowak alleged that the two exchanges aided and abetted the unnamed thief who stole the funds and that the exchanges remain in possession of the funds. It is an interesting accusation for sure, but one that seemingly had no result that can be found online, which can only lead us to assume that the case was thrown out.

Proof of Reserves

Proof of reserves may be a late trend in the crypto space, but for good reason, due to a number of collapses in the industry, with FTX being the latest, (but most likely not the last). As such it is crucially important that many exchanges are using it to ramp up their image and claim some competitive advantage in the cut-throat competitive crypto exchange business.

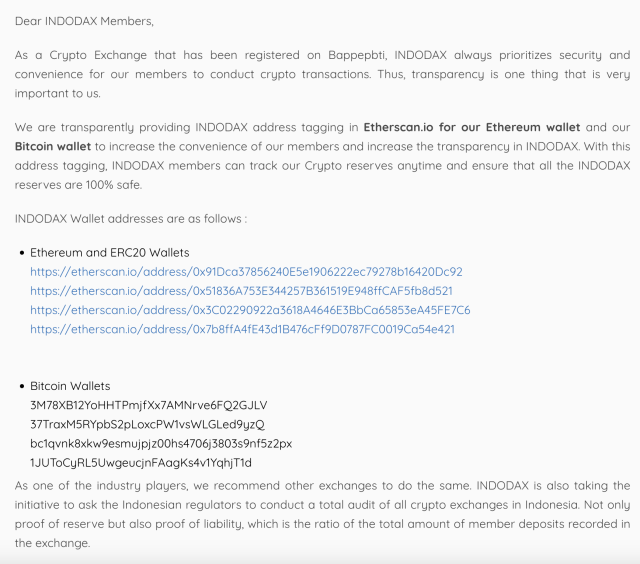

Indodax has put its cards on the table in this regard, claiming that their top priority is transparency. They achieve this by providing Etherscan.io with the exchange’s Ethereum and Bitcoin wallets. Members can then conveniently track all the crypto reserves anytime and ensure that all the Indodax reserves are 100% safe.

They have gone as far as assuring their users of not only proof of reserves but also proof of liability- which they encourage the Indonesian regulators to conduct a total audit of other exchanges to ascertain their level of transparency. (As a reminder or to explain to the uninitiated, Proof of Reserve is a method of verifying if an exchange has 1:1 backing across the digital assets it holds in custody on behalf of its customers. Proof of liability, on the other hand, is the ratio of the total amount of members' deposits recorded in the exchange.)

Conclusion

Indodax is an exchange giant in Indonesia and is widely considered the biggest Bitcoin platform in the country. The growth is backed by their impressive services, including a large number of crypto assets and trading pairs on offer, great customer support, and a simple but efficient trading platform among others. However, there are a few downsides to the platform, like the fact that the exchange only supports one fiat currency- IDR- for both deposits and withdrawals. In addition, the exchange does not offer margin trading, which can be a dealbreaker for many experienced and advanced traders. Nevertheless, overall, Indodax ticks many boxes for average traders and is great for those in that region of the world taking their first steps into crypto buying and trading, and is well worth checking out.