INX

INX Review 2023: An Expert's Comprehensive Analysis

4.2

4

4.3

4

4.5

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

INX prioritizes regulatory compliance for enhanced security.

Trade security tokens for increased liquidity and asset accessibility.

INX Limited is an IPO-backed, well-established company.

Owning INX tokens ties your success to the platform's popularity, potentially leading to value appreciation.

Cons

INX's KYC requires you to submit very personal and sensible information such as your Social Security Number or Taxpayer Identification.

While compliance is a plus, regulatory changes or uncertainties can affect operations.

Depending on its development stage, INX may offer fewer features and assets compared to more established exchanges.

Key Takeaways

Origins

Introduction

The INX platform isn't just another face in the crowd; it's an innovative company that boasts a formidable team of experts hailing from business, finance, and technology sectors. What sets INX apart is its laser focus on curating assets meticulously on their INX.One platform.

This remarkable hub is more than just an exchange; it's a groundbreaking creation, heralded as the world's first fully regulated platform where users can buy and sell tokens classified as securities by the SEC.

Geared predominantly towards the U.S. market, INX places a special emphasis on security tokens, both in their issuance and trading.

Join CoinScan as we dive deep into what INX has to offer!

History

Ah, let's rewind the clocks and travel back to 2017 when INX burst onto the crypto scene like a digital comet. In a move that shook the crypto cosmos, INX made headlines by submitting an F-1 registration statement for a regulated Token Offering.

A Regulated Token Offering is a type of public offering in which tokenized digital securities, known as security tokens, are sold in security token exchanges.

Fast forward to mid-2021, and you'd find INX flashing a dazzling $85 million success story, capping off its primary offering with a whopping 7,000 investors from 75 different countries joining the party. It was a global celebration, and the world was watching.

What sets INX apart from the cryptocurrency crowd isn't just its success in raising capital; it's their audacious choice to lock arms with regulators back in 2018/2019. INX didn't tiptoe around the rules; they waltzed hand-in-hand with regulators, paving the way for a regulated token offering framework that's as clear as crystal. It's as if they were saying, "Crypto, meet compliance. Now, let's dance!"

INX's journey to the stars didn't stop there. The exchange rocked the boat again by launching the first-ever SEC-registered Security Token IPO in August 2020. They weren't content with just making waves; they wanted to make the whole sea ripple. And ripple it did!

Taking yet another bold leap, they secured a spot on the secondary market, turning the INX Token, a true-blue Security Token, into a star readily accessible for trading by the general public.

User Experience

Ease of Use & Design

Picture this: you land on the homepage, and right off the bat, you're met with a beautifully crafted landing strip for your crypto journey.

Now, let's swoop down to the Markets section, where the action heats up. Prices? Check. Trading volume? Got it. Market capitalization? Oh, it's there. And for those who love charting their course, a sleek chart depicting an asset's price journey over time is at your fingertips.

The fonts are big and bold, making it a breeze to read, no matter your device. The organization is spot-on, with headings and subheadings guiding your way. And let's not forget the vibrant blueish color.

Regarding the INX ONE trading platform section. As you step onto the homepage, you'll encounter a captivating two-act play:

The organization is on point, with headings and subheadings acting as your trusty compass. A vivid palette of colors and captivating images makes each scroll a visual delight, and the search bar is your treasure map's "X" marks the spot.

For those who want to send a message to the crypto oracle, a contact form is tucked away at the bottom, ready for your summoning.

And there's one more twist in this enchanting tale – the platform is very much mobile-friendly, with an app (INX Buy & Trade Crypto) that has more than 10k downloads and a rating of 4.5 stars welcoming all new and veteran crypto traders.

Usage and Popularity

INX has made it their mission to ensure even the greenest of traders can navigate their platform without breaking a sweat. Picture an interface so user-friendly that beginners will feel like crypto pros.

But here's the rub, the signup process can be a bit like a marathon – it requires a detailed info dump including your address, phone number, and country of residence.

Once you've shared those precious personal details, the powers that be at INX let you loose on their platform. However, don't set your heart on regular crypto trading here. INX seems to have its sights set on a different star, shining brightly in the realm of Security Token trading.

Now, when it comes to numbers, INX is a bit of a mystery. No user statistics are shared on their website, keeping their user base a closely guarded secret. Yet, here's the plot twist – INX is the first SEC-registered broker-dealer in the United States.

It's like they've snagged the crown jewel of crypto legitimacy, poised to ascend the ranks of popularity in due time. As of October 2023, approximately a jaw-dropping 135,219,627.93 INX Tokens are circulating in the digital stratosphere.

Customer support

Let's delve into the realm of customer support at INX, where assistance is available. While the avenues are not overly abundant, the good news is that INX does provide a live support feature for those urgent moments.

If you're seeking crypto guidance, you'll find yourself utilizing a customer form on the support page. It's akin to sending a digital message in a bottle, with responses typically landing in your inbox within a reasonable yet potentially improvable 24-hour window.

For quick answers to common queries, the FAQ page stands ready, offering a plethora of information. Visual learners will appreciate INX's treasure trove of instructional videos, guiding you through the nooks and crannies of their platform.

Now, while INX's customer support has its merits, it's not without its nuances. The absence of a dedicated phone line may be a drawback for those seeking immediate assistance. However, it's noteworthy that INX has taken steps to address this gap by incorporating a live support feature.

Some users have reported challenges in withdrawing funds beyond the USA's borders, likening it to sending a postcard to Mars. The Know Your Customer (KYC) verification process, which took a week for completion, has tested the patience of a few. In a twist of events, there have been accusations of INX closing accounts without notice, sparking concerns of financial uncertainties.

In summary, while the treasure map to customer support is available, be prepared for a few twists and turns. The addition of a live support feature is a positive step, but some challenges persist, reminding users to tread carefully in their quest for crypto solutions.

Fees and Promotions

Fees

INX has thrown its hat into the cryptocurrency exchange ring, and like any contender, they have their own specific fee structure.

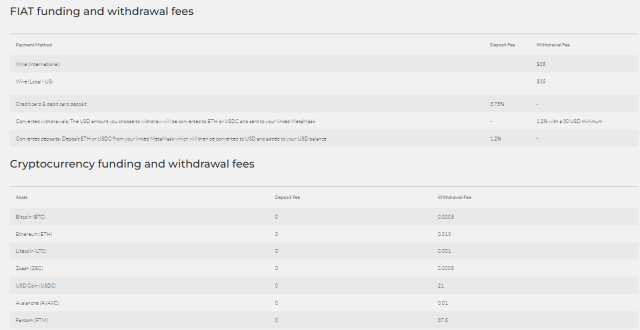

For the makers of crypto magic, it's a 0.3% fee based on the notional amount, akin to the price of admission for a show. On the flip side, the takers in the crypto realm will need to part with 0.4% of the notional amount, a tad more to join the party.

When it's time to take a final bow and cash out your digital assets, you'll need to consider the $35 fee for both Wire (International) and Local (US) withdrawals.

To kick off the show with security tokens, there's the all-encompassing trading fee of 0.45% of the notional amount for both maker and taker orders, ensuring that everyone gets a slice of the action. And for the token aficionados, remember that the minimum order size for INX tokens is a charming 100 INX, granting access to the INX party.

As the curtain falls on the fee showcase, INX Token holders are in for a treat, with discounts based on their token balance over the past week. It's like a loyalty program that keeps on giving, offering sweet discounts ranging from 5% to a dazzling 20%.

So, as you navigate the INX wonderland, be aware that these fees may change.

When it's time to fuel your INX adventure, the stage is set for deposits with options as diverse as a crypto carnival. For our U.S. audience, the welcome mat is laid out for Visa or Mastercard credit/debit card deposits. But beware, there are daily deposit limits, and these tiers are like the rings of a circus: Basic ($1,000), Pro ($10,000) and VIP ($20,000).

But there's more to the show; you can also deposit using a range of cryptocurrencies, including Ether (ETH), Bitcoin (BTC), and USD Coin (USDC). These digital coins can be converted into a USD balance, though it does come with a fee. And if you're an international traveler in the crypto-sphere, bank wire transfers are your ticket to the INX realm.

When it's time to exit the crypto carnival, INX offers a flexible withdrawal process, ensuring your journey concludes just as smoothly as it began. To comply with Anti-Money Laundering (AML) regulations, FIAT withdrawals must be channeled to an account under the INX ONE account holder's name. Monitoring the status of your cryptocurrency withdrawal transactions on the blockchain explorer adds an extra layer of vigilance.

Comparison

In the dynamic and ever-evolving world of cryptocurrency trading, it's crucial for traders and investors to choose the right platform that aligns with their specific needs and preferences. In this comparative analysis, we will take an in-depth look at two prominent cryptocurrency exchanges, Binance and INX.

When comparing INX to Binance, some key distinctions emerge:

In summary, both Binance and INX excel in various aspects, and users should consider their specific needs and priorities when choosing between these exchanges.

Safety Essentials

Security

In the world of crypto, security is the crown jewel, and INX takes it quite seriously. Their approach to safeguarding customer assets involves a Segregated Account system. This system keeps client funds separate and securely stored with reputable financial institutions.

Notably, funds within your Security Token USD balance find a haven in a US bank account registered under your name. Furthermore, this institution is a member of the FDIC, providing insurance coverage for balances up to $250,000.

INX Digital Company, Inc. and its subsidiary entities have diligently crafted a Bank Secrecy Act and Anti-Money Laundering Compliance Plan. In addition, they've developed a Business Continuity and Disaster Recovery Plan (BCDRP), outlining their response to potential significant disruptions in business operations. These plans provide a safety net for users and ensure the platform's ability to navigate through various scenarios.

To meet regulatory obligations and reinforce its commitment to customer protection, INX enforces a very strict Know Your Customer (KYC) policy. This policy is accompanied by a clear and comprehensive disclosure regarding the Prohibited Use of the platform, aligning INX's actions with both security and regulatory compliance.

These measures collectively underscore INX's commitment to safeguarding customer interests and upholding regulatory standards.

Controversy

INX, operating under the banner of an SEC-registered broker-dealer with CRD number 162182, carries the torch of regulatory compliance high. This coveted registration, courtesy of the U.S. Securities and Exchange Commission (SEC), isn't just a badge of honor; it's a declaration of INX's unwavering commitment to upholding the gold standards of regulatory governance.

But as with any show, there's a flip side, and for INX, it includes the occasional critique. Some reviews have raised concerns about certain limitations, from withdrawal restrictions for international users to the intricate Know Your Customer (KYC) verification processes, like hurdles on the path to crypto glory. Despite all of this, in general though INX has no real stain on it's reputation and so far looks promising as it continues to grow!

Proof of Reserves

Proof of reserves is a critical aspect of trust and transparency in the cryptocurrency exchange space, and INX demonstrates a commendable commitment to these principles. As a fully audited public company, INX operates with a high degree of financial accountability.

Notably, the platform publishes audited financial statements on a quarterly basis, providing users with clear insights into the health and security of their holdings. This regular financial scrutiny reinforces INX's dedication to maintaining a secure and trustworthy environment for its users.

Moreover, INX's regulatory oversight further bolsters its credibility. The platform is registered with the U.S. Securities and Exchange Commission (SEC), one of the most formidable regulatory bodies globally.

INX's combination of public audits and SEC registration exemplifies its strong commitment to financial transparency and regulatory compliance, making it a noteworthy player in the cryptocurrency exchange landscape.

Conclusion

The INX ecosystem is built on a sturdy foundation, including The INX Digital Company, Inc., INX Limited, and INX Securities, LLC, which collectively signify a resolute dedication to legal compliance and unwavering regulatory adherence.

One of INX's standout performances is its versatile array of trading services. It harmoniously combines the worlds of cryptocurrency and security token trading, ushering users into a realm of diverse investment opportunities, all accessible from a single platform.

The availability of various order types adds a dynamic touch, catering to traders of different styles and risk appetites. However, it's essential to remember that such a grand performance doesn't come without a ticket price; INX applies trading fees, with maker orders incurring a 0.3% fee and taker orders bearing a 0.4% cost.

INX is like a star in the crypto constellation, shining brightly with its regulatory compliance. It has gained the seal of approval from formidable bodies such as the SEC and FINRA, a testament to its commitment to maintaining a secure and dependable trading environment.

While the platform provides flexibility in deposit methods, offering a bouquet of options to fund accounts, keep in mind that there are withdrawal holds and associated fees in this journey, just like toll booths on a highway, so plan your transactions accordingly.