Kraken

Kraken Review 2023: An Expert's Comprehensive Analysis

4.2

4.5

3.75

4.5

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Good security measures

Low fees in comparison with other exchanges

Easy-to-understand interface

Good customer service and educational resources

Cons

A limited number of coins

No leverage trading options

Key Takeaways

Origins

Introduction

Most people have heard of the Kraken - a mythical monster that could sink a ship in seconds and was unchallenged in the water.

Clearly the next exchange on our review wanted to lean into that idea, becoming the beast that would rule the uncharted sea of Defi and crush the competition. Of course we could be talking about none other than the international cryptocurrency exchange Kraken, one of the largest in the world in terms of trading volume.

Kraken's mission is to make cryptocurrencies accessible to the whole world and enable users with the means to gain financial independence.

But has Kraken exchange managed to adhere to its motto of “Forward, to the Open sea of success!” or is its message of power to the people a bit of a red herring? Join CoinScan as we set sail to find out!

History

The American exchange Kraken appeared on the cryptocurrency market in 2011, making it one of the OG exchanges in the murky waters of DeFi. Currently, the company is headquartered in San Francisco, California, and its founder and CEO of Kraken was Jesse Powell, up until April 27th, 2023. On that date, Jesse Powell stepped down and Dave Ripley was appointed the new CEO in charge of Kraken.

The creator apparently foresaw the importance of Bitcoin and blockchain from the very beginning of the cryptocurrency boom, specifically its potential to aid the masses in achieving financial independence.

According to the businessman he then became dedicated to expanding Satoshi Nakamoto’s vision and creating newer, efficient solutions in the field. During the first years of operation, the exchange was in the shadow of competitors, but since mid-2014, its popularity had begun to rapidly grow.

This was largely due to the bankruptcy of the MtGox exchange, which at that time influenced the balance of power in the market. Many traders and investors who previously worked with MtGox switched to Kraken, which offered favorable trading conditions. Initially, the listing included only Euros, Bitcoins, and Litecoin. Gradually, the list of assets expanded, other fiat and digital currencies were added, and trade turnover increased.

In 2014, the Kraken exchange became the world's largest exchange in terms of BTC/EUR trading volume – setting itself apart from the competition.

The site continued a steady growth to the top of the pile, apart from one major setback in 2017 – a number of DDoS attacks, which brought the company to its knees and disrupted its platform for a number of days. Fortunately Kraken survived and continued its journey upwards.

User Experience

Ease of Use and Design

Kraken can be used through a mobile app (Google Play or Apple) or web browser, with the latter being its Pro version. However, unlike many of its competitors, the exchange has everything possible in order to keep beginner investors comfortable when using the site, regardless of the version being used.

As a direct comparison, (on its Pro version), competitor Binance’s web interface assumes that users are somewhat familiar with crypto exchanges and as such does zero hand-holding.

Kraken is different in that its design is more reminiscent of Coinbase, with a simple and intuitive interface, and clear explanations of how to perform the various functions and features of the platform.

As a specific example, to place a buy or sell order, users simply select the "new order" tab, pick their desired cryptocurrency and fiat pair, and choose whether to use a market or limit order. Layout, colors, and large text also make the process easier for users new to crypto. For anyone who likes the simplicity of Coinbase, Kraken is a good fit in this regard. In general, the platform's usability is where Kraken really excels, and perfectly balances simplicity with functionality.

The site also prides itself on being one of the easiest and most beginner-friendly platforms that are great for those just starting their crypto journey, and as such it makes it far less likely someone will accidentally send their funds into a DeFi black hole.

Usage and Popularity

Due to its origins Kraken is popular amongst old-school investors, mainly based in the USA. Despite this, the platform has struggled to dominate over its direct competitor Coinbase in the country, despite the latter having less trading features available compared to its international versions.

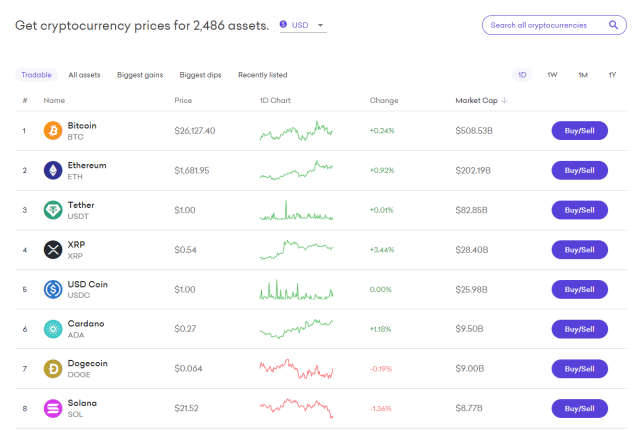

Kraken is available in over 170 countries and has over 9 million users, earning a solid reputation in strong cryptocurrency markets of North America, Europe and beyond. Below is a list of the countries with the highest Kraken web traffic as of April 2022.

Also, the platform got some hype during the NFT boom. Following the example of other major cryptocurrency exchanges, in November of 2022, Kraken launched the beta version of its NFT trading platform available for testing, with it due to go fully live next year in 2023.

The Kraken NFT Marketplace will apparently offer a zero-fee platform for NFTs held by Kraken. There will be no blockchain network fees for trading activities on the platform (although there will be network fees for transfers from the website). The platform will also provide the following features:

Ethereum and Solana were the only two networks supported for a long time, but the team has recently been adding more blockchains such as Algorand, Cardano, Polkadot, among others.

Customer support

The fact that many crypto exchanges have poor customer service teams and options is one of the most common concerns among regular traders. Due to the lack of decent support, getting things sorted out is often quite challenging and can spell the difference between customers using an exchange or not – so it is a crucial factor. In this regard, Kraken has built a great reputation for offering quick and dedicated customer support, such as having a live chat service available around the clock and being able to answer the vast majority of questions on the spot.

Kraken apparently employs hundreds of specialists for this task – formed of professionals in the crypto and financial sectors – as well as of course being experts in the exchange’s own products and services.

It seems the exchange is dedicated to upholding this reputation, and the prompt responses to requests are actually tailored to the individual rather than being boilerplate responses, which is a huge green tick for Kraken. In terms of communication types, users can contact specialists via an online chat or email. Also, there is a reference section where all stages of the working process are systematically described in detail.

In terms of phone support, only the US get that honored privilege, with the rest of the world having to resort to online contact.

Regardless, the fact that Kraken even offers phone support at all is already a massive win compared to 95% of the exchanges in the crypto industry that don't, and is why Kraken gets a high score in the customer support section.

Fees and Promotions

Fees

The first action any user typically takes on an exchange is to top up their balance. In this regard Kraken excels, as there are no applicable fees for depositing. There are withdrawal fees however, with the commission rate dependent on the withdrawal currency and method (I.E. Bank account or credit card). Kraken's trading fees themselves are directly related to volume: the more a user trades, the lower the commission on subsequent buy/sell trades. Thus, the commission on the exchange is calculated according to the maker-taker principle and depends on the trading volume for the last 30 days.

For example, spot trader fees on the site range from 0% to 0.26% and are calculated depending on the total volume of transactions, (which provides better liquidity for the exchange). This means it is easier for traders to make trades at the price they want, encouraging them to stay in the market. In addition, Kraken features various other fee brackets, based on the type of trading. Stablecoin, Pegged Token & FX Pairs commissions on the site for example are also directly based on the total trading volume.

They provide high liquidity, tight spreads, and minimal slippage. In contrast, their Dark Pool orders (separate order books not visible to the rest of the market, allowing individuals to place large trades discreetly) range from 0.20% to 0.36%, which is 0.20% more than the standard limit order rates (0% to 0.16%). In other trade types, margin trading fees are applied in addition to trading fees when opening and closing margin positions. The amount of commission depends on the base currency.

Kraken’s Futures fee schedule offers volume rewards based on users’ trading activity over the past 30 days. It is important to note here that volume in Kraken spot markets, currency pairs, and stablecoin order books does not give any volume-based discounts to Kraken futures and vice versa.

Comparison

Kraken is one of the oldest and largest exchanges in all of Crypto. It's safe to say that comparing it to some of the older exchanges becomes rather difficult, as many did not survive long enough to be around to this day. Most of Kraken's competitors are about half it's age, if not less. An obvious candidate for comparison that comes to mind is Bitstamp, who holds the record for the oldest crypto exchange, and happens to still be around to this day.

Both exchanges have amazing customer support alongside strong user reviews. The real distinction boils down to user interface, Kraken is a lot friendlier than Bitstamp for less experienced users.

Additionally Kraken also has slightly better fees which can be crucial sometimes for those first starting out in the world of Cryptocurrencies. Kraken is no slouch in the trading department either, boasting much more cryptocurrencies available to it's users, as well as nearly 4x the volume of Bitstamp, it's clear to see that while Bitstamp maybe the oldest exchange, Kraken has certainly aged better when it comes to todays standards for exchanges (low fees, wide selection of tokens, great UI and customer support).

Safety Essentials

Security

Kraken is a centralized exchange, and all user assets are held in internal accounts. 95% of assets are stored offline in secure distributed ‘cold’ storages in order to help protect from unwanted attacks. The platform is also subject to the regulatory requirements of all jurisdictions in which it operates. Top marks so far. Like many of its contemporaries, Kraken also offers two-factor authentication (2FA) to protect user data using a phone number and an authenticator code. In addition to the authenticator application, it is possible to use the YubiKey (a hardware authentication device) with the site. A trader can also create a PGP key for enhanced account security if they prefer. Unlike other well-known cryptocurrency exchanges, Kraken also offers advanced options for using two-factor authentication. A user can allow a 2FA request to generate and add an address, confirm transfers and withdrawals, place orders, and stake or withdraw coins from staking.

Moreover, it should be noted that Kraken Security Labs is constantly working on subsequent solutions to increase the security level. This is because the exchange, unfortunately, is prone to hacker attacks. The Kraken team has years of experience building security programs for the world's leading brands, investigating consumer data breaches, developing security technologies that millions of companies trust, and finding vulnerabilities in technologies used by billions of people every day.

Kraken security uses the following procedures and features:

Controversy

Unlike many modern crypto exchanges, Kraken hasn't raised doubts regarding its solvency. However, Kraken does have some tarnish on its sheen – specifically for being the victim of different hacker attacks.

There were even cases when the platform temporarily closed account registration due to the wave of hacker requests (such as mentioned previously).

Also, there have been some suggestions that Kraken’s base architecture was not designed for such a high number of people and workload and this is why at the peak popularity of Bitcoin, the exchange once again temporarily shut down.

On top of this, in November 2022, Kraken agreed to pay $362,000 in compensation for violating U.S. sanctions against Iran. The platform voluntarily disclosed violations that took place between October 2015 and June 2019.

During this period, Kraken processed 826 transactions worth $1.7 million for users who were based in the country– despite Iran citizens being banned from trading digital assets.

According to OFAC this became possible due to the fact that the exchange did not implement a system for blocking IP addresses associated with sanctioned jurisdictions. After discovering the issue, Kraken began using blockchain analytics tools to monitor unwanted activity.

The company has also hired a dedicated sanctions executive to lead its compliance efforts. To settle the claims, Kraken is currently investing $100,000 in compliance controls in addition to the fine.

Proof of Reserves

In the 13 years since the invention of Bitcoin, it is estimated that more than $23 billion of digital assets have been lost to hacks and insolvencies. Through Kraken's commitment to ongoing Proof of Reserves reviews, it is believed the company can mitigate critical risks to client funds.

Armanino LLP's Proof of Reserves audit is the second of its kind on the exchange since 2014 and confirms that more than $19 billion worth of Bitcoin and Ethereum clients are safe – and provably so – on the platform. This includes $3.5 billion worth of ETH held in the secure online staking service. While the audit only covers 2 of more than 100 assets available for trading on the exchange, it is a crucial step in the right direction and aims to promote the recommended standards for new crypto audits that many hope will become common in this industry.

Kraken also allows all of its clients to check the audit on their own, and offers a handy step-by-step guide of how to do so here.

Conclusion

In 2011 Kraken was the only marketplace in the US that allowed Bitcoin to be traded against dollars and euros.

Since that time Kraken has had many competitors emerge, but the exchange has a strong reputation as a serious and influential player in the market and the trust of millions of traders around the world.

Crucially the company is developing its reach in the most popular areas, improving and expanding the platform's functionality, but still struggles against major competitors such as Coinbase. Much attention is paid to the convenience of the platform and the quality of service, as well as security issues. Being one of the first exchanges to launch has given Kraken plenty of time to mature and perfect its security and functionality, and as such it is considered one of, if not the safest cryptocurrency exchange.

That said, as with any exchange there are no guarantees, and caution should always be executed when storing and trading assets.

It is also worth highlighting that Kraken became the first cryptocurrency platform to introduce a full audit system (Proof-of-Reserves), which cryptographically checks if the balances of exchange users match the funds in Kraken wallets.

Thus, the exchange tries to demonstrate transparency even in the face of unfair competition when trading platforms artificially increase trading volumes behind closed doors, and more could benefit from the transparency that the company offers users. While it might not be the only beast in the sea of DeFi, Kraken has certainly proven itself to be one of the biggest out there, and its many limbs of operations should see it definitely considered as a viable trading station.