Kuna

Kuna Review 2023: An Expert's Comprehensive Analysis

4

4.5

3.75

3.75

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

No leverage

A small range of tradable assets

No staking programs

Cons

Simple, modern design with an easy-to-use interface

Strong security credentials

Efficient and secure mobile app

Great customer support

Key Takeaways

Origins

Introduction

Next up on our deep dive series is Kuna – one of the few exchanges that allow users to directly buy digital assets with Ukrainian fiat Hryvnia (UAH). Known to offer some of the world’s most popular crypto assets, the Lithuania-based exchange claims to appeal to the greater Eastern European market among other claims.

But how true is this claim? Join us at CoinScan as we dive deep to unearth the good, the bad, and the ugly of this exchange.

History

Kuna Exchange’s journey set sail in Ukraine 2015, under the vision of a platform allowing Ukrainian crypto traders to directly purchase the most popular digital assets with the Ukrainian Hryvna.

The first exchange to emerge from the Commonwealth of Independent States (CIS) region was founded by Michael Chobanian, a Ukrainian businessman whose interest in Blockchain technology started back in 2011 when he enrolled in a professional course on the burgeoning tech.

The idea to build Kuna Exchange (Kuna.io) was conceived way back in 2014 when Chobanian founded KUNA Bitcoin Agency and the non-governmental organization Bitcoin Foundation Ukraine (BFU).

By September of the same year, he established the first Bitcoin Embassy in the CIS countries following a successful initial coin offering (ICO)- and this would pave the path for the release of KUNA Exchange’s beta version in December 2015. The exchange would receive its biggest-ever global recognition when it became the biggest fundraising platform in Ukraine after accumulating over $100 million in donations for war victims, following the 2022 Russian invasion of Ukraine.

The successful fundraiser was through the Crypto Fund for Ukraine- a special dedicated partnership between Kuna Exchange and Ukraine’s Ministry of Digital Transformation.

The exchange’s fundraising phenomenon was highlighted by many international media and news agencies like the Washington Post, Forbes, TechCrunch, WSJ, and Fortune among many others.

User Experience

Ease of Use and Design

The ease of use and design of a trading platform is what determines users’ overall experience.

To this end, Kuna Exchange has been built with a simple and modern design that makes it one of the easiest platforms to navigate. Moreover, users can enjoy the simple modern platform in three languages: English, Ukrainian, and Russian. Beginner users will most likely enjoy the platform more, with its straightforward approach to buying and selling cryptocurrencies.

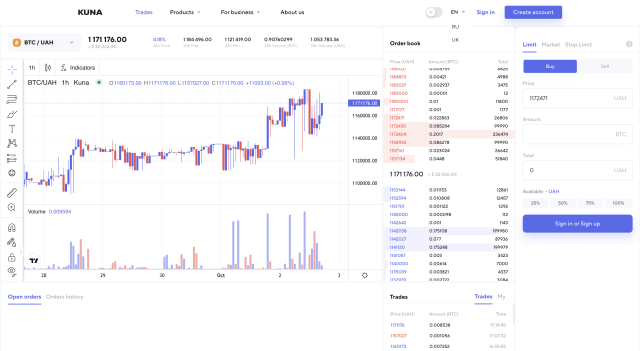

Regarding the trading view, the exchange has a detailed trading view whose order book consists of specific features including:

The trading view also has instant tracking of orders and personal portfolios of cryptocurrencies. Overall, the trading view is quite simple and intuitive at the same time.

The exchange uses video presentation services to introduce new users to the world of crypto trading. The introductory video takes new users through the process of using the platform - making it quite user-friendly.

In addition to its mobile-optimized website, Kuna Exchange also has a mobile app that can be downloaded on either the App Store (iOS) or Google Play (Android). The app is a perfect fit for those who love to trade on the go. Solid stuff.

Usage and Popularity

The Ukrainian exchange is one of the few platforms located in Eastern Europe that accepts direct purchase of digital assets with Ukrainian fiat currency - a feat that has seen it attract a large native user base over many direct competitors. The platform also allows crypto-to-crypto trades with dozens of trading pairs involving some of the world’s most popular crypto assets.

On depositing funds into a Kuna account, the exchange does allow fiat currency (UAH) deposits via credit cards - a service that’s rarely offered by many of its peers. However, credit card deposit is only allowed to Ukrainian credit card holders, which further cements the belief that the exchange is focused primarily on the Ukrainian market.

The exchange recently added the US dollar and Russian RUB among the supported fiat currencies, but only through certain versions of the platform such as Advanced Cash, Perfect Money, or KUNA Code.

Kuna Code is the exchange’s own special deposit method only available to a select group of users.

The exchange, however, does not support wire transfers- which is quite unusual as this is a pretty standard deposit method.

In terms of tradable assets, Kuna Exchange started with only popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoin Tether (USDT) when it opened shop back in the day; however, the exchange has since expanded its list of digital assets on offer to 21 coins and 37 trading pairs with tokens like XRP, Waves, EOS, and Bitcoin Cash topping the list of the most popular additions.

Whilst not a large selection compared to the big boys, it isn’t bad for a fairly niche exchange. With this in mind, at the time of writing its 24-hour average traded volume is $1.4 million, with the most traded pair of USDT/UAH reporting a daily average of $511,000.

Despite the fact that it is niche as just mentioned, this is still pretty low for a centralized exchange, and technically disqualifies their claim of being a global brand or even a regional giant in the exchange business.

Like many international exchanges, Kuna Exchange does not support traders from the United States, which is hardly a surprise considering the US seem to not want to invite anyone but the select few to their elusive crypto exchange inner circle.

Customer support

These days nearly every exchange seems to be struggling to cope with the basic demands of customer service.

However, in this regard Kuna has attempted to make its customer support better than the masses. The exchange has email as the primary means of reaching its customer support team, although others like Telegram, Messenger and Viber are also available.

Information about a call center, however, hasn’t been provided on the website, so we presume it doesn’t exist (when does it ever).

More importantly, users can reach the customer support team 24/7, with an assurance of fast response to every query – and apparently backs up this promise by actually doing it.

This is quite impressive in an industry that seems to constantly struggle with customer support. Pretty good here from the exchange.

Fees and Promotions

Fees

Trading fee is a big consideration for many crypto traders because it affects the overall profit a trader takes home. In this area, unlike many trading platforms, Kuna applies a flat trading fees formula for both takers and makers.

Flat fee formula means that the exchange doesn’t separate between takers and makers when it comes to trading fees.

The good news is that its flat trading fee, set at 0.25%, is just within the industry average and is likely to be attractive to takers.

Makers, on the other hand, may find it less attractive as there is an emerging trend of an increasing number of exchanges charging zero maker fees. To qualify for this attractive offer, a user must deposit a minimum of 100 KUN- the exchange’s native utility ERC20 token.

One more thing to note is that while the fee model may not put Kuna Exchange at any significant advantage against its competitors, some exchanges charge more competitive fees- often averaging 0.20% (taker) and 0.10% (maker), so it’s not exactly leading the charge here.

In terms of withdrawals, costs vary depending on the cryptocurrency. For example, it charges 0.0005 BTC for Bitcoin withdrawal, which is a touch below the industry average- making the exchange quite competitive.

Comparison

Kuna and Kraken are both based out of San Francisco, so lets see how they compare to each other;

Now lets take a second and analyze the differences between both;

Those looking for an exchange that offers a good range of cryptocurrencies and support for an easy to use platform with a small selection of tried and tested cryptocurrencies will find some appeal with Kuna. However, retail or institutional investors looking for an exchange with a wide range of trading features, a high daily trading volume, and support for a variety of fiat currencies will find Kraken suits their needs better.

Safety Essentials

Security

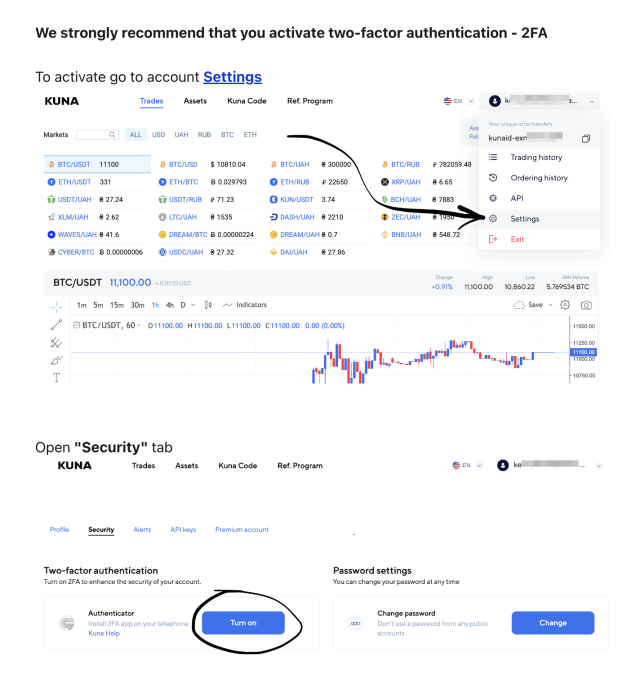

The exchange has incorporated the latest protocols to ensure maximum security. For instance, all the data on the platform has been encrypted, from the start (login stage) to the end of the transaction. The exchange also employs email authorization and 2-factor authentication (2FA) to protect users' accounts from any unauthorized access or withdrawals.

Kuna also adheres to the Anti-Money Laundering (AML) and Know-Your-Customer (KYC) requirements, which demand users submit proof of identity to access certain features, and is becoming increasingly standard fare for exchanges.

The security protocols look to work well for the exchange, simply because it (as yet) has never dealt with any problems associated with bugs or hacks. To add credence to the success of its security protocols, Kuna has some of the most positive feedback from the online crypto trading community.

Moreover, the exchange is big on transparency as it displays all the team behind it on video and has made it available to everyone to see on the website’s home page. Big thumbs up here.

Controversy

Controversy has never been good for any business, but particularly in an industry abound with scams and misdeeds – hence companies tend to avoid controversial events or actions to preserve their brand.

However, it is almost impossible to be the main figure of the biggest crypto fundraising for war victims without being involved in some major news (or scandals).

A online theory emerged stating that FTX had helped the Biden Administration funnel funds supporting the Ukrainian war effort back to the Democratic Party. This speculation was rapidly spread on Twitter and had to be refuted by the deputy minister of digital transformation of Ukraine, Alex Bornyakov.

According to Kuna's CEO, Michael Chobanyan, FTX's role was limited to serving as a platform for converting cryptocurrency into cash. Kuna would transfer their digital assets to FTX, exchange them for cash, and subsequently utilize the funds to meet the army's financial needs

It's important to note that this matter didn't have repercussions and there was no proof backing the allegations.

Several articles and media outlets even called it russian propaganda and linked it to some political groups.

Proof of Reserves

Proof of reserves- an auditing technique used to confirm assets on hand- has become an integral part of the crypto exchange business. Exchanges are expected to publicly show that their digital assets vault has been audited by a reputable/registered third-party auditing firm.

Kuna claims that all the amounts under their custody are backed with real money with 100% reserve- and that users can withdraw all money from their account without any detrimental effect on the exchange’s operations.

However, they have fallen short of showing any proof of this claim- as nowhere have they named the external auditor that did the proof of reserves auditing on their behalf. Kuna needs to step up here.

Conclusion

Kuna Exchange has cut a name for itself in the crypto ecosystem with one of the most transparent business activities in the space.

Giving users access to some of the most popular coins and a couple of trading pairs, simple but modern trading interface, low trading fees, high security and transparency, great customer support, etc., the exchange has done well for itself.