MAX Exchange

Max Maicoin Review 2023: An Expert's Comprehensive Analysis

4

4

4

4.5

3.5

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Strong security and high level of stability

Exceptional trading terminal

An efficient mobile trading application for iOS and Android

Great rewards for MAX token holders and stakers

Customer support mobile phone number

Cons

No demo accounts feature

No training programs or enough educational materials

Key Takeaways

● Has never been hacked (top-notch security mechanism) ● Lots of features, especially those supporting fiat-crypto transactions ● Easy-to-understand trading terminal

Origins

Introduction

Our deep dive journey today takes us to Max Maicoin- a leading digital assets trading platform that has been offering fiat-to-crypto and crypto-to-crypto exchange services for close to a decade. Arguably the largest digital asset marketplace in Taiwan, the exchange is known for its robust fiat capabilities, innovative features, and strict adherence to regulatory requirements. But can this exchange really help users to max coins, or is it a max con? Join us at CoinScan as we roll up our sleeves and find out!

History

Max Maicoin opened its shop in 2014 as an over-the-counter (OTC) platform allowing crypto enthusiasts to purchase Bitcoin. Founded by Alex Liu- who also doubles up as the CEO- the exchange targeted continuing interest in (and expansion of) cryptocurrency in Southeast Asia to help fill the void left by regulatory uncertainty in China and Korea. Alex, who is a native of Taipei, Taiwan is a graduate of Stanford Department of Electrical Engineering accompanying an illustrious career in the world of tech in the world’s top tech companies like Hitachi, Samsung, Siemens, and Qualcomm.

The growth of Max Maicoin can be attributed to the Taiwan government’s ambivalence toward cryptocurrency. Unlike China and South Korea, Taiwan through the Financial Supervisory Commission (FSC) did not adopt the high-handed approach to digital currency.

The exchange was the first to the market with almost every crypto asset traded in Taiwan, as well as the first digital asset platform in Taiwan to facilitate fiat deposits through thousands of 7-11 and Hi-Life convenience store ATMs and Kiosks nationwide.

In 2015, the exchange introduced the merchant services industry when it launched a series of apps to facilitate point-of-sale (PoS) transactions to help local businesses accept crypto payments more seamlessly.

Other than the digital assets trade, the company continues to expand its business operations to include blockchain solutions- working closely with other financial institutions like JP Morgan, ITRI, Fubon FHC, and Taishin Bank among others.

User Experience

Ease of Use and Design

One of the most important features that define a trading platform’s growth trajectory is the ease of use, which is a fundamental factor of design. The first aspect to look at here is how easy it is to sign up on the platform. In this regard the exchange has been designed with a simple-to-use interface complete with a “sign-up” button. To register, a user will need to submit the required data name, password, and email- to get started, and set up 2-factor authentication (2FA) to add more layers to the user account’s security.

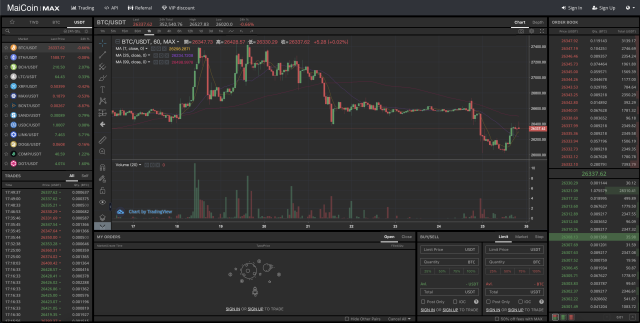

There is also the platform’s trading view, which is an important aspect of user's experience. Although no trading view can be universally flawless- as it is the question of personal preference- Max Maicoin’s trading view is quite smooth and displays all the important features like order history, buy-and-sell boxes, and a price chart of any selected crypto.

An active user account at Max Maicoin starts once money has been deposited into the account. The deposit methods accepted by the platform are wire transfer and debit card. (The exchange does not accept credit card deposits.)

The wire transfer deposit option is a big win for Max Maicoin prospective users who may have not had any crypto holding before- as they can easily register on the exchange and start trading straight away. Another job well done.

Usage and Popularity

Max Maicoin allows users to trade with cryptocurrency pairs comprising of Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Chainlink (LINK), and stablecoin Tether (USDT) among other dozens of cryptocurrency pairs. As a leading exchange operating in Taiwan, it has established itself as a reliable platform for trading major digital assets- with its strong points being security, dependable API, and low fees. For merchants, Max Maicoin is a convenient way to get paid via digital currencies like Bitcoin, which can be converted to fiat currencies.

The exchange had initially started as Taiwan Dollar (TWD)/ Crypto pairs; however, as part of its global aspirations, it introduced dozens of crypto pairs including USDT and TWDT stablecoin pairs. (The TWD fiat trading is only open to the citizens of Taiwan.)

The exchange has significantly grown through partnerships with other financial institutions. For example, it currently partners with a digital currency platform in the Philippines – coins.ph – allowing Filipino migrant workers in Taiwan to make regular, small remittances back home. This is part of the long-term strategy that the company has established to extend its services to the larger Southeast region’s underbanked population.

Max Maicoin comes with its native token, MAX Token- a utility token that users can trade or use to purchase other assets. They can also earn rewards by staking MAX Token on the Max Maicon platform. Some of the top reasons for the exchange to release MAX tokens were to share the benefits of trading with clients and to create discount opportunities for traders- in an attempt to increase the growth of the exchange.

When trading on the platform, a percentage (30%) of trading fees is billed in MAX token (after it’s converted via the open market). Holders of the token can stake it on the Max Maicoin platform to earn five times more staking power- better than the unstaked tokens. Moreover, the longer the staking stays, the higher the staking power through what is referred to as an “aging boost” which will also determine the amount of MAX Token airdropped.

Although the exchange’s primary market is in Taiwan and the greater Southeast Asian region, its services can be accessed worldwide, including in the United States. Users can access the platform via its secure web-based platform as well as the mobile app (Android and iOS).

Today, Max Maicoin has 31 coins and 58 trading pairs on its platform- with a 24-hour average trading volume of $11 million and the most active trading pair, USDT/TWD, reporting a daily trading volume of $6 million. (The number of coins may be limited compared to many of its global peers; however, to be fair it’s still a decent offer package to its growing user base.)

Customer support Quality customer service is crucial, since traders trust the exchange with a significant amount of their funds. In this regard Max Maicon provides exactly that, with a customer support team ready to assist with any query or concern. The team operates during working hours or 10.00 am and 06.00 pm Arabian Standard Time (AST), Monday to Friday. They can be reached via email and even a phone number (which is the crypto equivalent of a photograph featuring a Yeti riding a Unicorn) - giving Max Maicoin a competitive edge. The fact that the exchange’s customer service support can be reached faster, and feedback received promptly is part of the reason the exchange is currently receiving rave reviews and the rise in the number of customers trading on the platform.

Fees and Promotions

Fees

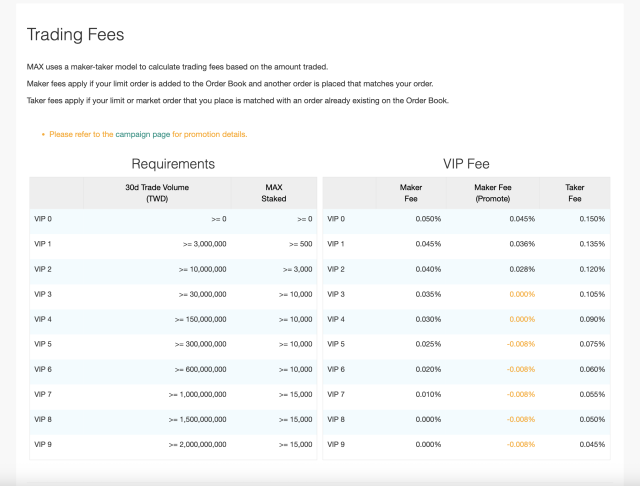

The role of trading fees on the success of a trading platform can never be overstated- as it is an important factor to consider while accessing exchanges. Exchange fees can vary significantly from one exchange to another- and affect the trading costs as well. Most trading platforms use the maker-taker fee model and Max Maicoin is no different here.

Max Maicoin’s taker fee is set at 0.15%- which is way lower than the industry average of 0.25%. This makes the platform one of the cheaper options available in the market today, and the exchange’s industry-low taker fee will not eat into a trader’s profit in comparison to most other exchanges.

Just like some of the most popular exchanges, Max Maicoin has one of the industry's low maker fees of 0.05%- which gives it a bit of a competitive advantage. More importantly, the low maker fees help the exchange maintain higher liquidity- a dream for any exchange. (It is important to note that some exchanges have adopted zero maker fees to improve the platform’s liquidity.)

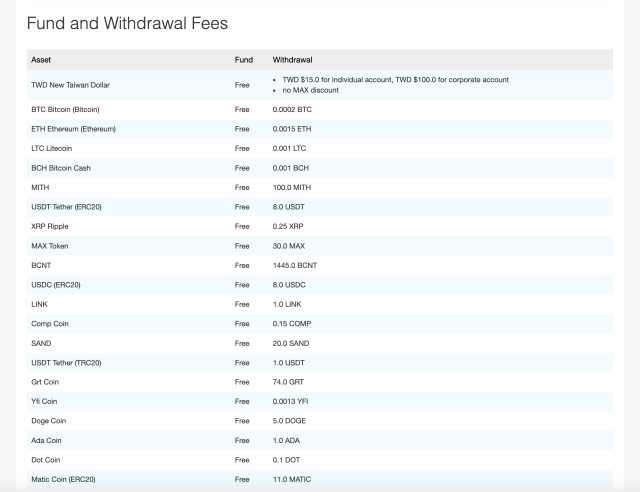

Another plus is that Max Maicoin also charges zero fees on crypto deposits. This means that a user can easily deposit any supported cryptocurrency, including stablecoins and DeFi coins, without incurring any deposit fee.

The other significant aspect of exchange fees is the withdrawal fee. Max Maicoin charges a fixed rate for withdrawing any amount of crypto asset- although this fee varies per crypto asset. In other words, the withdrawal fee remains the same irrespective of the amount of crypto asset being withdrawn but varies based on the type of cryptocurrency being withdrawn. For example, the platform charges 0.0005 BTC to withdraw Bitcoin- which is less than the industry average of 0.0008 BTC at the time of writing. It is worth noting that Max Maicoin has set withdrawal limits, which vary depending on the time frame of the withdrawal.

Comparison

What better way to compare Taiwan's Max Maicoin with another exchange than to pit it head to head against Indonesia's own Indodax and see how these two country exclusive exchanges really stack up against each other.

Here are the differences between the two exchanges:

Focus and user reviews Max Maicoin is focused on retail investors in Taiwan, while Indodax is focused on retail investors in Indonesia, also Max Maicoin has much better overall reviews than Indodax. If you are a retail investor in Taiwan looking for an exchange with a wide range of trading features, then Max Maicoin is a good option. If you are a retail investor in Indonesia looking for an exchange with a high daily trading volume, then Indodax is as good as it gets.

Safety Essentials

Security

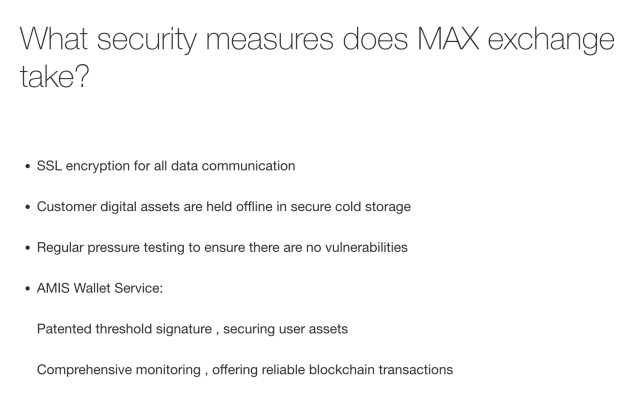

The need for a secure digital assets trading platform has never been so urgent, following a series of security breaches that have affected the crypto exchange industry over the last few years. This is another area where Max Maicoin has established strong credentials. The exchange is a secure platform that strives to protect not only funds under its custody but also user data.

First, the exchange uses cold storage to hold crypto assets in its vault. To protect user data, the website is encrypted with SSL to protect all data communication. To add more protection to the exchange, the company conducts regular pressure testing to ensure there are no vulnerabilities when in use.

The exchange’s AMIS Wallet Service is also another highly guarded wallet with its secure user assets and comprehensive monitoring, as well as a reliable underlying blockchain.

For users, Max Maicoin employs 2FA authentication to ensure a second layer of security is established to protect user accounts. This ensures that even if the account is compromised, the third-party infringing the security of the account may not have full access if they cannot access the owner’s phone. Solid stuff.

Controversy

One of the few old decentralized exchanges with no worthwhile story regarding controversies.

The crypto space has experienced a fair share of controversies recently- with cases of hacking, security breaches, and theft of digital assets becoming a common occurrence everywhere within the crypto space.

Our assessment has returned zero cases of hacking or even rumors on social media space concerning bad actions by Max Maicoin.

The fact that the exchange hasn’t experienced any serious cases of hacking or security breaches for close to 10 years of operations is clear proof that they are doing good work across the board. We just hope they keep it up!

Proof of Reserves

Proof of reserves has become so important in the crypto business that exchanges are working to assure their users that they are liquid enough with adequate backup to their funds. Investors are also becoming more aware and demanding that the exchanges prove their liquidity for them to feel safe investing. Despite the rising significance of the liquidity assurance, Max Maicoin- just like many other crypto exchanges- is yet to make public their proof of reserve or any indication that their reserves have been audited by reputable third-party auditors. This is something they need to sort out asap.

Conclusion

Max Maicoin was one of the original pioneers of the crypto exchange business in the Southeast Asian region- and it has more than earned its accolades with impressive customer support, top-tier security features, a seamless user interface, an efficient fiat-to-crypto trade, and great rewards for its MAX token holders. Also backed by the increase in demand for cheaper, faster, and more efficient cross-border remittances, the exchange has become a reliable platform for those who send money back home from working abroad. However, the one main area the exchange needs to work on to improve is the number of coins and trading pairs on offer. This will enable greater opportunity for crypto traders who may want to venture into other new emerging digital assets. Nonetheless, Max Maicoin still stands out as a reliable, easy-to-use, and secure platform for traders of levels.