MEXC

MEXC Review 2023: An Expert's Comprehensive Analysis

4.1

3.5

5

3.5

4.5

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

High-speed trade execution

Low fees compared to rivals

Supports popular cryptocurrencies

A straightforward platform for novices

Allows staking - potential to earn passive income

Detailed identification progress for further protection

Cons

A complex fee structure that varies based on the assets being traded

Only has a few crypto assets compared to competitors

It is not available in all 50 States in the USA

Binance US is without an official headquarters

The parent company was hacked in 2019

Lengthy identification customers may put customers off

No phone support

Key Takeaways

Origins

Introduction

In the world of overhyped, suspicious, and trendy crypto exchanges, there is still room for ‘quiet’ options such as Mexc Global.

There is shockingly little buzz, mystery, or controversy surrounding this platform. At first glance it operates well, has a healthy number of trading pairs, ETFs, and high leverage. Not to mention their proof of reserves ratio is exceptionally high. So is this a case of walk softly and carry a big stick? Mexc on a surface level is ticking all the boxes so far.

The platform is minimalistic and speedy and has over 10 million current users. Dare we say it just does what it says on the tin? Let’s dive into Mexc Global to find out!

History

Mexc Global was established in 2018, just after the crypto bull run in 2017. Its founder, John Chen, still the exchange's CEO, was one of the first to implement high-performance and mega transaction matching technology on the platform.

Mexc Global was initially oriented on delivering a rapid and easy crypto trading experience, but it grew to provide broader possibilities over time. Including staking, mining, ETF trading, and the list goes on.

There's only a little information publicly available about the platform's development history: since 2018's down market, it was slowly but steadily growing into a significant exchange.

Its native token, MX, was released simultaneously with the platform's launch and, to this day, keeps giving the holders large fee discounts and exclusive voting rights on the platform.

Later, when the crypto world began to move to the PoS (Proof of Stake) consensus mechanism, Mexc also started offering various staking options ($USDC, $BTC, $ETH, etc.).

During the DeFi rush and memecoin-fever, the exchange began to offer DeFi staking and meme coins trading. It's apparent that MEXC has maintained it's position as one of the biggest players in the crypto space by always adapting quickly to the ever changing landscape that we live in.

User Experience

Ease of Use and Design

Even though Mexc Global positions itself as ‘The First User-friendly Cryptocurrency Service Provider’, its UX is somewhat in the middle compared to other intuitive crypto exchanges such as Binance, Coinbase, and Kraken.

However, Mexc Global can be a great option for beginners, as it offers a comprehensive learning section. This section covers a wide range of topics, including the basics of cryptocurrency, tips & tricks about futures trading, etc.

Users can also learn about technical analysis and how to use various TA tools and techniques to make informed trading decisions.

In addition to the learning section, Mexc Global offers a demo trading platform for users to practice their trading skills without risking real funds. The demo trading platform is a simulated trading environment that allows users to trade various cryptocurrencies using virtual funds.

Users can try out different trading strategies and techniques and get a feel for the platform without the risk of losing real money.

Demo trading is a valuable tool for newcomers to the crypto market, as it allows them to learn and practice without the pressure of real financial consequences.

Usage and Popularity

Under the guidance of the current CEO, the company has become one of the largest and most trusted crypto exchanges, particularly in Asia.

Mexc is labeled as "The most popular and best trading platform today" for its outstanding service and robust security. Recently the company has reported that more than 10 million verified users have registered on the platform, with various trading experience levels and goals.

In addition to the growing number of users, Mexc has also provided various platform services to over 70 other countries worldwide.

Due to Mexc's market position in three key markets - Europe, North America, and Asia - it has been granted an exclusive license in many countries where crypto can be a bit more problematic such as:

The exchange has its own token in the form of MX. Like many other exchanges, Mexc gives holders of its token exclusive benefits on the site such as reduced trading fees, access to exclusive events and promotions, and voting rights on platform decisions.

Additionally, Mexc Global has a buyback and burn program for MX, which means that a portion of the tokens is regularly purchased and destroyed, potentially increasing the value of the remaining ones (although of course cryptocurrencies can be inherently volatile, so caution should always be exercised when considering a digital asset).

In addition, Mexc Global has quite a few "earn" options that allow users to earn cryptocurrency through various methods, such as staking, trade mining, or participating in events or promotions.

Staking typically involves holding a certain amount of a particular cryptocurrency in a wallet on the exchange and earning rewards for doing so. Mexc Global features both usual staking and ETH 2.0 staking as an option for passive income for its clients.

Trade mining is another potential stream of passive income featured exclusively on Mexc Global. It involves earning rewards for making trades on the exchange, with the rewards being paid in a specific cryptocurrency.

For all its great features however, Mexc Global has room for improvement in certain areas, such as staking, where Mexc falls heavily behind competitors such as Binance in terms of the range of "stakeable" assets and the rewards given for them.

When it comes to discussing Mexc, Crypto ETFs (Exchange-Traded Funds) will invariably become part of the conversation.

For those unfamiliar, ETFs are investment vehicles that track the performance of an underlying basket of assets, and they can be bought and sold on exchanges just like stock.

This trading method has become a popular way for investors to gain exposure to the cryptocurrency market without directly holding and managing individual assets themselves.

Mexc Global is one of the few exchanges that currently offer ETF trading for cryptocurrencies, making it a go-to destination for investors looking to diversify their portfolios with multiple cryptocurrency assets.

One of the main advantages of ETF trading is its added layer of diversification. By investing in a crypto ETF, investors can gain exposure to a broad range of assets within the cryptocurrency market rather than having to choose individual coins.

Exposure to ETFs can reduce risk and smooth out the ups and downs of the market, but note that it is not a guarantee of a return or safety when investing either.

With the ETF trading option, Mexc Global brings "conventional" diversification methods to the crypto market. It gives investors the convenience of being able to buy and sell their ETFs through a single platform rather than having to manage multiple individual assets. This can save time and make it easier for investors to stay up-to-date on the performance of their portfolios.

Customer support

Unfortunately, in terms of customer support, Mexc Global is where the crypto exchange finally drops the ball.

There is no phone number (when is there ever?) to contact customer support. But in theory, users worldwide can still contact specialists via online chat or email.

Also, there is a reference section where all stages of the working process are systematically described in detail, which is a nice touch.

But in practice, it’s a whole different story. The process of getting replies from customer service has been reported as ‘frustrating’ and ‘non-satisfactory’ by several users, and there doesn’t seem to be a coherence to the process.

For example CoinScan found that this page was updated 3 years ago, and at the bottom is a section that states, ‘Please feel free to contact live customer service:’. But there is literally no button to click.

Clearly customer service doesn’t want to be contacted.

Fees and Promotions

Fees

Mexc's fees are generally very competitive with other digital asset exchanges, but the exact fees may vary depending on the asset being traded.

Trading fees: Mexc Global charges a fee for each trade on the platform. The fee is typically a percentage of the total value of the trade and is based on the user's trading volume. High-volume traders may be eligible for fee discounts or other incentives. Mexc Global Exchange charges a 0% for both marker and taker fees for spot and margin trading, making it one of the few exchanges out there that don't charge spot trading fees.

For futures trading, the maker fee is 0.0%, and the taker fee is 0.010%, for users who do futures and leverage trading (especially with large capital sizes), you will likely not find better fees than this anywhere else.

Deposit fees: Some assets may incur a fee when deposited to Mexc Global. These fees are typically small and are used to cover the cost of processing and to secure the deposit. Unlike many other exchanges, Mexc Global does not directly charge these fees. Therefore, the deposit fees are usually 0% unless your bank charges them.

Mexc Global offers exclusive tiers or other incentives to users who trade large volumes or hold significant assets on the platform. These perks may include reduced fees, access to exclusive trading tools and resources, and other benefits. The tiers are divided into several levels, Gold, Diamond, and Premium VIP, with each level offering a different set of benefits.

Users who qualify for the Gold VIP tier (their total assets exceed $300,000) receive reduced fees on trades, as well as access to exclusive trading tools and resources, such as MEXC Industry Analysis Report.

The Diamond VIP tier is typically reserved for users who trade even larger volumes or hold a larger amount of assets on the platform (their total assets exceed $1,000,000). Users in this tier may receive even more favorable trading fees and additional benefits such as dedicated account management and access to exclusive events and promotions.

The Premium VIP tier is usually reserved for the highest volume traders or those with the most significant assets on the platform (their total assets exceed $3,000,000). Users in this tier may receive the most favorable trading fees and extensive benefits, including personalized support and tailored solutions for their trading needs.

The lucky owners of the Premium VIP are also invited to Mexc's offline events and prioritized in the new product beta testing.

It is important to note that fees and incentives may change over time, so it is advisable to check the Mexc Global website or contact the exchange directly for the most up-to-date information on fees and incentives.

Comparison

Both Kraken and MEXC are notable players in the expansive realm of cryptocurrency exchanges. Founded in the 2010s, they have each grown in prominence due to their diverse offerings and dedication to serving the global crypto community.

Each platform supports a wide array of cryptocurrencies, facilitating spot trading and futures contracts for their user base. Security is a shared priority, with both exchanges integrating multiple layers of protection, including two-factor authentication, encryption, and cold storage measures.

Furthermore, both exchanges aim to provide comprehensive educational resources and customer support to guide both new and experienced traders in their crypto journey, although Kraken certainly has the edge here in customer support. While they share some common ground, Kraken and MEXC diverge considerably in their operational approaches and market focus.

Kraken, established in 2011 with its headquarters in San Francisco, has always placed a significant emphasis on regulatory compliance, particularly in the U.S., offering a sense of trust and transparency. Its regulatory alignment makes it more selective in the tokens it lists, tending to focus on more established and well-recognized cryptocurrencies.

MEXC, on the other hand, founded later in 2018, offers a broader range of altcoins, catering to a global and notably Asian audience. Its vast token variety can be alluring to traders seeking niche projects or a wider range of investment opportunities.

Additionally, while Kraken has a solidified reputation due to its longevity and focus on regulation, MEXC's dynamic approach appeals to those looking for rapid access to new tokens and projects. Ultimately, while there are some similarities, the notable differences are the amazing fees (or lack thereof) and larger variety of coins on Mexc, so more experienced traders you will certainly love the exchange.

Security Essentials

Security

One of the critical features of Mexc Global exchange is its focus on security and compliance.

The platform utilizes advanced security measures such as cold storage and two-factor authentication to protect user assets.

2FA is an extra level of protection. Instead of getting access instantly by login, a user receives a request for a six-digit code sent to their phone.

While 2FA is a standard method of additional protection for all exchanges, an anti-phishing code is a unique feature put into place exclusively by Mexc Global.

The exchange also follows KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations to ensure compliance with legal and ethical standards. Overall, Mexc Global takes a proactive approach to security and works to ensure its platform is safe and secure for its users.

Mexc has been granted licenses in many countries worldwide. Consequently, Mexc is compatible with various financial messaging standards, such as SWIFT. Users can easily connect their existing financial accounts and use Mexc to exchange cryptocurrencies and fiat currencies seamlessly.

In addition to supporting SWIFT, Mexc also offers support for other popular financial protocols, such as SEPA. This makes it easy for users to connect their accounts and manage their financial transactions through the platform.

Controversy

As shocking as it is, and we don’t want to jinx anything, it seems there has been literally zero controversy around Mexc Global.

It's important to note that just because an exchange has a perfect track record it does not guarantee that this will always be the case. Always use caution when handling digital assets whether it's on an exchange or personal wallet.

So far they haven’t gotten involved in any major scandals and thus far no successful hack on the platform has been reported – which is obviously a green flag in terms of high-security standards.

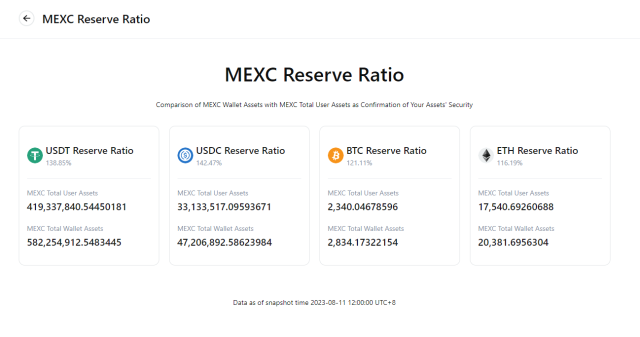

If anything the exchange just seems to receive nothing but good PR and awards. This certainly shows that Mexc is on top of their game. Even their liquidity reserves are exceptionally high, with every major crypto over a 115% asset ratio, which is one of the highest ratios among top exchanges. More on that next.

Proof of Reserves

If the recent FTX collapse and Luna crash have taught us anything, it’s how crucial it is to analyze a company's investments and look deep inside the company's architecture.

Because no matter if the exchange is centralized or not, backed up by insurance, it's still under a high risk of financial trouble, especially during the crypto market's upheaval.

The company's investments can tell a lot about what's happening in it, what vector the company follows, and last but not least, whether it has the clients’ money.

Mexc releases on their website a public proof of reserves with total assets and liabilities, and it's clear to say these are some of the best reserve ratios we've seen on the market from any exchange. The report on recent venture and seed rounds that Mexc Global has participated in shows a healthy activity. The exchange made quite a few investments in Q4, Q3, and Q2. There were eight funding rounds, which in total amounted to $57.4 million gathered.

Mexc has invested in Krypton, TwitterScan, Orderly Network, and other projects inside the crypto industry.

Just to mention, Mexc Global isn't a venture capital firm, so it doesn’t throw money around often like this. These are just notable investments they've made recently that have paid off well.

However, the already existing investment activity from the exchange is a green flag that indicates two things:

First of all, the exchange has quite a lot of money to spare, which is an excellent indicator that despite the down market, things are going comparably well for Mexc.

Secondly, the investment portfolio of Mexc has all the signs of healthy diversification and long-term thinking inside the company. The investment choices virtually exclude the possibility of cross-enterprise fraudulent activity and strongly uplift the company’s image.

Conclusion

In summary, Mexc Global Exchange is a digital asset exchange platform that offers a range of good services, including spot, margin, and futures trading and investment products such as ETFs.

The platform is known for its focus on security and compliance and charges competitive fees for its services, and a huge plus is that it hasn’t become involved in any scandals.

A big downside is its poor customer service, but if that can be overcome by being aware beforehand, the impact of this can be mitigated.

Overall, Mexc Global is a reliable and user-friendly platform well-suited for professional traders looking to take advantage of the high leverage and advanced features with almost no fees!