OKX

OKX Review 2023: An Expert's Comprehensive Analysis

4

4.25

4.25

3.5

4

Overview

General

Fees

Customer service

Requirements & Accessibility

Pros

Relatively low fees

Large selection of trading pairs / cryptocurrencies

Great mobile app and user friendly platform

Cons

Very limited customer support

Total blanket ban on China

Key Takeaways

Origins

Introduction

OKX is an innovative cryptocurrency exchange that offers cutting-edge technology – all of which is necessary for hassle-free, successful trades and investments when diving into the world of Cryptocurrencies.

OKX is a popular service that caters to millions of users around the globe, prohibitive politics do not get in the way – more about that later.

But what makes this exchange stand out among its contemporaries, does it offer anything different, and has it managed to dodge any typical crypto exchange controversies and scandals?

All will be revealed as Coinscan combs through everything OKX!

History

Although not as large as exchanges such as Binance or Coinbase, OKX is a well-renowned cryptocurrency exchange established in China, Beijing, in 2013, before moving to Seychelles in 2017 following political issues.

It is known for being one of the fastest, most reliable crypto trading applications for investors and professionals around the globe.

The CEO of OKX is a Chinese entrepreneur named Star Xu, who is also the founder of OKCoin - a smaller crypto exchange by comparison. It seems owning 1 crypto exchange is just not enough for some people.

Users can consider this a plus as it shows a track record for building sustainable and well run exchanges.

Although OKCoin offers users the ability to trade, stake, and access numerous DeFi protocols and initial coin offerings like OKX, it does not include the large variety of tokens OKX offers, nor does it have crypto mining options for those who complete their KYC registrations.

Unlike its sister site, OKX continuously climbs its way up the ladder, religiously implementing new trading and staking strategies and some of the industry’s hottest DeFi protocols and coin offerings.

On top of that, the exchange is a top partner of many sports teams and players, including:

Following this, the exchange uses its celebrity target market to its advantage, supercharging fan experience through unique celebrity engagement and financial offerings on the platform.

To bring more creators into Web3, OKX is also a top partner of the Tribeca Festival and uses the exchange’s crypto wallet to bring in more users wanting to buy and trade NFTs, DeFi, GameFi tokens and more.

User Experience

Ease of Use and Design

One of the benefits of OKX is that its users can easily partake in numerous forms of decentralized financing through a generous selection of assets.

Using DeFi options, such as DDEX and Aave (among others), the platform consists of contrasting interest rates depending on the type of token wanting to borrow, buy or trade, and also enables peer-to-peer lending services with flexible terms.

Better still, funds are accessible to onboard, trade, and withdraw. For purchasing purposes, users can buy crypto in a few easy steps, using the following:

Thankfully, the platform accepts payments from 92 different Fiat countries and 99 different cryptocurrencies to assist all members.

Furthermore, the platform includes many enticing features that are super simple to understand, use and navigate – even for crypto novices who don’t understand typical crypto -related buzzwords that commonly arise.

The website's layout also fits its purpose well – it is straight to the point without too many meaningless visuals taking away users' attention.

However, the few moving, 3D visuals on the homepage represent the product nicely – intelligent, tech-savvy, and straightforward (just like the exchange itself).

Another plus side is that, unlike all other crypto exchanges, OKX supplies historical market data, including OHLC data, trades, and order books.

Thanks to these features, users can do all the necessary research before making investment and trading decisions regarding tokens and NFTs. Therefore, better decision-making is made rather than jumping the bullet and making impulsive purchases or trades.

Usage and Popularity

OKX is a well known and respected exchange in the crypto industry. In terms of volume and popularity, it is definitely in the top 10 worldwide, which is no easy feat to accomplish.

OKX is punching with the heavyweights like Kraken, Bybit, Kucoin, and even Coinbase in terms of volume and site traffic.

OKX launched it's native crypto token, $OKB on March of 2018, 1 year after launching the exchange in 2017. The token current sits at a marketcap of $2.6 billion and is one of the larger cryptocurrency tokens in the world.

With a reported user count of 50 million across 180 countries globally and a strong token to back it up, OKX is on it's way to becoming a top 5 cryptocurrency exchange in no time.

Customer Support

Customer support services for crypto exchanges are essential. After all, it only takes the wrong crypto URL link to get users in a sticky situation, or the wrong network address for assets to vanish into the ether.

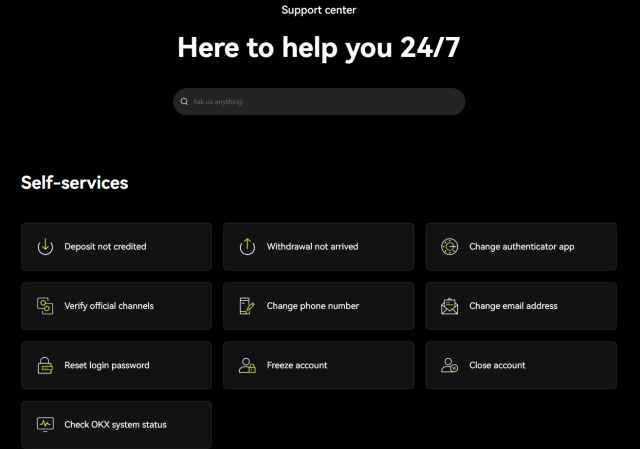

Fortunately, OKX has a 24/7 support center where users can type in questions and await direct responses, alongside a section that answers the most commonly asked questions, like: “Why hasn’t my crypto arrived?” “How do I fix a deposit with tag issues?” “What are untradable assets?” and so forth.

Supplying a list of answers to potential questions saves OKX’s support team from constantly going over the same old ground and gives users the necessary information with a few taps of the keyboard.

However, many people would much prefer to get straight to the point and speak to someone on the phone. Unfortunately, if there is a phone number, it’s hidden in the depths of the internet where no one can find it.

Additionally, if users struggle to find exactly what they are after, there’s an AI bot to provide support at all times of the day and night.

Although, like the majority of AI bots out there, it is akin to talking to a broken record with a slippery grasp of the English Language, so take that service with a pinch of salt

Another – and largely popular option – appears to be Twitter, where users can raise issues using OKX’s customer support Twitter handle, @OKXHelpDesk.

Fees and Promotions

Fees

Unlike other cryptocurrency exchanges – including the top industry giants Coinbase and Binance – OKX has a unique, complex policy regarding trading fees.

Members fall into different categories depending on customer tiers, trading markets and asset class. For instance, regular users get put into different tiers (Lv1 to Lv5) depending on their total OKB holdings (the global utility token issued by OKX).

The total amount of OKB in the main and sub-accounts is the total amount of the OKB holding, including both trading and funding accounts (savings excluded).

In contrast, VIP users are categorized into the tiers (VIP 1 - VIP 8), depending on the balances of their daily assets and 30-day trading volume, for OKX to decide who is entitled to generous fee discounts and who is not.

To clarify, the initial tier spot trading maker/taker fees for regular users is 0.08% - 0.10%.

Regardless, one of the issues members regularly raise is that - unlike many other crypto exchanges, OKX makes it difficult to define whether fee charges are high or low before making a transaction due to having this complicated fee schedule.

As a result, it would be more helpful for customers to have a comparison table, like Binance, which clearly and sufficiently presents the cost of fees that all users - regardless of crypto education - can understand.

Another contentious aspect of OKX fees is how the exchange constantly updates users' trading fees daily, at 9-11 PM UTC, to react to changes to their varying activities and performance.

Whilst some users may perceive this payment policy as an exciting way to stay enticed with the platform over potentially saving on daily fees depending on user activity, it largely appears to be another confusing negative that makes it difficult to anticipate costs when trading.

Additionally, another issue for option traders to be aware of includes options exercise fees, alongside liquidation and partial liquidation fees. OKX charges these fees when users exercise their options at a rate of 0.02% - which is applicable for both regular and VIP members.

While discussing fees, it’s also important to note that withdrawal fees on OKX depends on the cryptocurrency itself.

However, it has generous rates in relation to top cryptocurrencies, including BTC (0.0004), ETH (0,002), XRP (0.015), BCH (0.0001), USDTC-ERC20 (0.88), and others.

Comparison

Although Binance appears to be reaching the stars compared to OKX (which is still up there in terms of success rates and numbers of users, around 6-7 million visitors per month), the exchanges have more in common than meets the eye.

As mentioned, OKX was initially launched in China but had to move following crypto bans. Binance’s story is similar, launching in Hong Kong before moving to the Cayman Islands following increased government intervention in cryptocurrencies in 2017.

However, unlike Binance, OKX has struggled to reach a global audience, including the USA and Russia, following political matters getting in the way. However, residents from both countries can use OKX’s sister exchange, OKCoin - despite offering fewer coins and features.

For those not living in the USA or Russia and looking for a robust suite of crypto-based financial services, OKX is an exchange worth checking out.

Safety Essentials

Security

Crypto exchanges are no strangers to hacking and other nefarious security crime attempts, whether it be a technical glitch, rug-pull, or volatility.

Nonetheless, since FTX became bankrupt following its utter disregard for the most necessary industry regulations, there is no time like the present for all crypto exchanges - alongside their Web3 contemporaries - to get their ducks firmly in a row, ensuring they have these all-important security measures in place.

To ensure the safety of its customers, OKX uses both online and offline storage systems, which entail multi-signature protection.

Additionally, the exchange implements numerous notable backup features that protect all parts of the platform alongside its OXK Risk Shield, which automatically identifies fraudulent and suspicious activity.

To further emphasize security, the website also clearly states its security policies and requirements and how it stores 95% of funds on its offline, cold wallet system in case of any online issues. It has also announced it will start reporting its Proof of Reserves by the start of the New Year.

In terms of generalized security, all OKX members are required to have the following to prevent hacks and the occurrence of other fraudulent activities:

Although unlike other exchange platforms, OKX does not use an ordinary Transmission Control Protocol, (which is the standard method for allowing digital computers to communicate from afar that most online projects use).

Rather, it conducts communication via a unique and exceptional network communication protocol that persistently backs up all data offline, regardless of circumstances.

Of course, like all platforms, unexpected and unforeseeable events can occur. However, it’s good to know that OKX has all the necessary protection requirements, including multiple backups and incorporates contingency plans in case of an unfortunate event.

Controversy

Following OKX’s CEO’s nationality, OKX is under a ban by Chinese regulations - and has been tucked into it since October 13, 2021.

To stay alive, the company has numerous third-party outsourcing companies and staff outside the country and is registered under a Seychelles cryptocurrency exchange - to keep law authorities away.

Although, in this case, they are most likely just arm's length away, waiting for OKX to slip up.

As a result, according to the publication Ciaxin, OKX has made promises to Chinese authorities stating the firm will no longer perform any crypto activities in the Chinese mainland market, nor will it establish an office or team in the region.

Nevertheless, the crypto firm is said to have a prominent hub of Chinese workers from the mainland still working for the exchange, alongside many other Chinese connections partaking in crypto duties related to the company.

Another issue with OKX includes its inability to perform business in the USA following compliance and regulatory matters. Russia’s state media monitoring service, Roskomnadzor, also recently blocked the exchange last month (October 5, 2022).

According to Roskomnadzor, the exchange “entails pyramid schemes”.

Although, the media monitoring service gave scarce details regarding the full reasons behind the ban.

Interestingly, FTX is said to have turned to OKX for help before going bankrupt – after Binance changed its mind regarding taking over the exchange following taking a deep dive into its customer's records and company books, and finding itself somewhat disappointed (to say the least).

Luckily, Binance’s agreement took the pressure off OKX from standing in to help. OKX declined to move forward with the deal after expressing concerns that consolidation of exchanges would be a step backward for the industry.

Proof of Reserves

OKX publishes their proof of reserves on their website, here, and appears to update it monthly. They are definitely over collateralized, which is a great thing if you hold funds on the exchange. As you can see, most of their holdings are above 100% which means they have enough to cover every user and then some.

It's also nice because you can view your personal audit on the site, so every token you are holding in your on-site wallet can be viewed to see the collateralization rate on each token. Overall, it's nice to see that OKX is very transparent with their proof of reserves, something more exchanges could take a page from their book, and as of the time of writing, it's also worth noting that OKX announced on site that:

We released our ninth Proof of Reserves report maintaining a reserve ratio exceeding 100% for nine consecutive months

This is also something worth praising, especially in a bear market. Props to OKX here.

Conclusion

Overall, OKX seems to be a promising exchange that has yet to break out into the mainstream in terms of popularity and volume (overshadowed by Binance, Coinbase, Kraken, Bybit and other massive players). It offers fantastic security features to make users feel at ease, and the UI and overall platform is simple to use and intuitive enough for most users to grasp quickly and benefit from. The only real negatives here are the lackluster customer support options compared to most higher end exchanges, and the ban on US and Russian users following sanctions and regulations.

If you're an intermediate - advanced user, and don't live in the US or Russia, OKX is certainly in the conversation when it comes to what exchange you should be using.